Trading platforms evolved fast. Most brokers now pack dozens of tools. But features alone don’t tell the whole story.

What separates Angel One from rivals like Zerodha and Groww? The answer lies in how quickly you can act when markets move. Speed matters more than ever, whether you’re chasing a breakout or rebalancing mutual funds.

Let’s break down 16 features that show where platforms truly differ.

Trade Without Tab-Switching

Most platforms force you to analyze charts, then switch screens to place orders. Those extra seconds add up, especially during volatile sessions.

Angel One’s Instant Orders tool eliminates that friction. You can place buy or sell orders directly from charts in a single tap. For fast setups like triangle breakouts or reversal candles, this matters significantly.

Index Trading Gets Simpler

Index moves often dictate the day’s tone. Yet acting on them usually means switching tabs, searching instruments, and navigating separate order windows.

Angel One’s Trade on Index feature merges analysis and execution. You can study index charts, track Calls and Puts with breakeven lines, and place orders directly from the same view. Plus, you can adjust lot size, limit price, stop loss, and target without leaving the screen.

Signals Replace Manual Scanning

Scanning dozens of charts manually wastes precious time. Real-time Trading Signals highlight key price action and technical patterns automatically.

Patterns like Morning Stars, inside bars, and open interest spikes appear directly on charts with color-coded bullish and bearish markers. Pair this with Instant Orders, and you go from spotting a setup to executing a trade in seconds.

Share Charts That Actually Work

Most brokers only allow screenshot sharing. Even Zerodha limits chart sharing within their own app.

Angel One’s Share Chart tool lets you send fully interactive charts to anyone, even outside the platform. The recipient can change timeframes and explore the chart in real time. This feature shows up frequently in WhatsApp and Telegram trading groups.

Trading Insights Beyond Basic Reports

Basic P&L or tax reporting doesn’t cut it anymore. Angel One’s Trading Insights breaks down performance by time of day, trade type, frequency, and peer benchmarks.

Such insights help traders adjust strategies. Maybe you discover you perform better in the morning. Or perhaps you’re overtrading. Either way, the data guides better decisions.

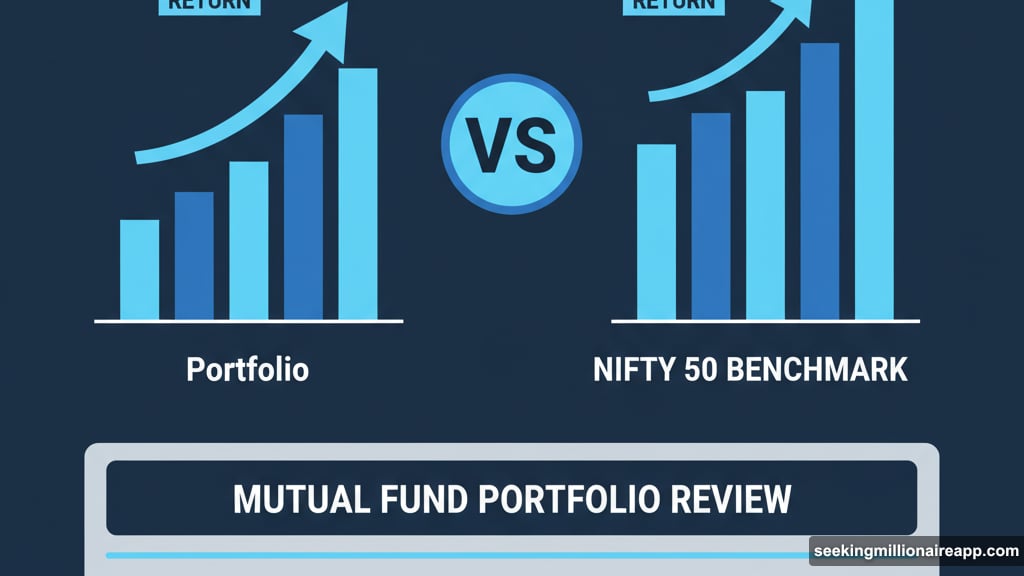

Benchmark Your Mutual Funds

Your portfolio made 8% last year. Sounds good, right? But what if Nifty 50 climbed 13% in the same period?

Angel One’s Mutual Fund Portfolio Review compares your returns against benchmarks like Nifty 50 or BSE 500. This shows whether you’re ahead or behind. The tool integrates into dashboards, so you don’t need to generate extra reports.

One Dashboard for All MF Holdings

Tracking mutual funds across multiple platforms gets messy fast. Angel One’s Unified MF Dashboard consolidates all holdings in one place.

This covers both direct and regular plans, along with category breakdowns and overlap analysis. The result? Less duplication, better diversification, and simpler monitoring.

Convert Orders in One Tap

When markets turn quickly, converting a limit order to a market order usually requires canceling and re-entering. That takes time you don’t have.

Angel One’s One-Tap Conversion & Exit reduces that friction. You can convert orders or exit positions directly from the Orders page. A toggle even lets you enable single-tap exits for faster reactions.

Set Up SIPs Without Juggling Apps

Setting up an SIP typically means managing payment apps, mandates, and manual approvals. Angel One’s 1-Click SIP cuts down that process.

Once Autopay is enabled, you can set up a plan in just a couple of taps. Choose the fund, pick the amount, and confirm. Payments are deducted automatically, so you don’t worry about reminders or missed installments.

Execute Multiple Stocks at Once

Buying or selling a group of stocks usually requires placing orders one by one. Angel One’s Basket Orders lets you create a set of multiple stocks or ETFs and execute them in a single click.

This makes portfolio rebalancing or strategy implementation far more efficient. No more repetitive clicking through the same process.

Trailing Stop-Loss Locks In Gains

A regular stop-loss helps cut losses. But what about locking in profits as stocks move in your favor?

Trailing Stop-Loss moves only in one direction, following the market price as it rises. For example, you go long on Infosys at ₹1,500 with a ₹20 trailing stop. If the price climbs to ₹1,540, your stop automatically moves to ₹1,520. If Infosys reverses, your position closes at ₹1,520, securing ₹20 profit per share.

Portfolio-Level Risk Management

Intraday and F&O trading move fast, and risk can pile up just as quickly. Angel One’s Secure Exit automatically closes all open positions when your total profit or loss hits your trigger.

You can set a loss limit, profit target, or both. Once triggered, all trades square off and linked orders cancel. Set ₹3,500 as loss or ₹5,000 as gain—whichever comes first, Secure Exit handles it.

GTT Orders That Wait for You

Good Till Trigger lets you set buy or sell orders at your desired price. They execute automatically when the stock hits that level.

No need to watch screens constantly. Orders stay valid for months, unlike regular day orders that expire by market close. This works for limit buys, stop-loss buys, limit sells, and stop-loss sells.

Manage Risk in One Step

Angel One’s Set Exit feature lets you place Stop Loss and Target together in one step. Predefined options and OCO (One Cancels Other) execution make it quick and stress-free.

This reduces the mental load of managing trades. You can trade with more confidence knowing your exits are already set.

Where Zerodha and Groww Stand

Zerodha offers Systematic Withdrawal Plan and Tax Loss Harvesting. Groww provides PnL-based Exit and Smart Exit features. Both include GTT orders, 1-Click SIP, and Basket Orders.

But the feature comparison shows clear gaps. Angel One provides 11 features that Zerodha and Groww don’t offer. This includes Trailing Stop-Loss, Instant Orders from Charts, Trade on Index, and Trading Signals.

What This Means for Traders

Top brokers take different approaches. But the pattern is clear. The more tightly integrated the tools, the smoother the experience.

Angel One stands out with the broadest feature set. From Instant Orders on charts to portfolio-level Secure Exit and advanced mutual fund benchmarking, the platform covers more ground.

Zerodha and Groww offer many basics. But Angel One adds layers that shorten the gap between analysis and execution. For traders, that means moving on opportunities more quickly. For investors, it translates to clearer context and simpler portfolio oversight.

The industry is evolving toward one-stop investment hubs. Angel One currently leads that evolution with tools that actually reduce friction where it matters most.