World Liberty Financial just dropped plans that could push crypto into your wallet. Literally.

The Trump-backed crypto venture announced two major product launches this week at Token2049 in Singapore. A debit card bridges digital assets with everyday purchases. Plus, tokenized commodities like oil and timber could soon trade on blockchain networks.

CEO Zach Witkoff and co-founder Donald Trump Jr. revealed the roadmap. Both products signal the company’s push beyond speculative tokens into practical financial tools. So crypto might finally escape the trading app ghetto.

Debit Card Lands This Year

World Liberty Financial’s debit card launches in pilot form within three months. Witkoff told the Singapore crowd it connects crypto holdings directly to retail spending.

“We’ll be rolling out a pilot program here in the next quarter,” Witkoff said. Full launch targets either Q4 2025 or Q1 2026.

The card addresses crypto’s biggest problem. You can’t buy groceries with bitcoin. Most merchants won’t touch digital assets. Yet crypto debit cards convert holdings to dollars at the point of sale. That makes crypto useful beyond speculation.

However, World Liberty Financial isn’t the first to try this. Companies like Coinbase and Crypto.com already offer similar cards. Competition in this space is fierce. So the Trump brand becomes the differentiator here.

Commodities Move Onto Blockchain

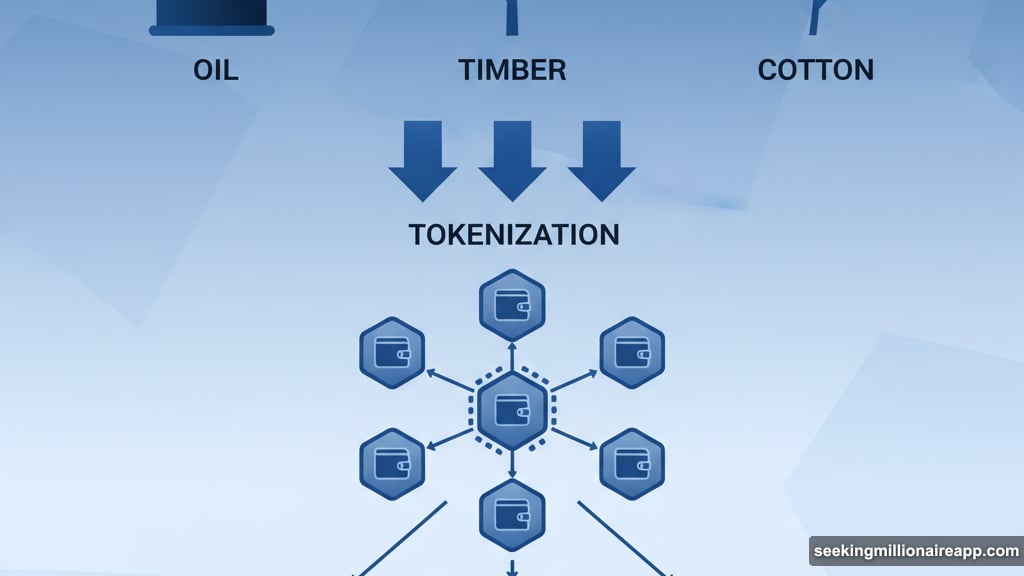

Tokenizing real-world assets represents World Liberty Financial’s second major bet. Witkoff confirmed the team is actively working on commodity tokenization.

“I think commodities are a really interesting area for us,” Witkoff explained. “Whether it be oil, gas, things like cotton, timber, all of those things, frankly, should be traded on chain.”

Tokenization splits physical assets into digital shares. That makes expensive commodities accessible to smaller investors. Instead of buying entire oil futures contracts, you could own fractions. Plus, blockchain trading happens 24/7 without traditional exchange limitations.

But here’s the catch. Regulatory frameworks around tokenized commodities remain murky. The SEC hasn’t clarified how these products should be classified. So legal challenges could slow rollout significantly.

Missing Utility Problem Gets Addressed

Trump Jr. acknowledged crypto’s core weakness during his CNBC interview. Most projects lack real-world utility.

“Ultimately, we’re looking to create utility; that’s something that’s been largely missing in crypto,” Trump Jr. said. The debit card and commodity tokenization both aim to solve this problem.

Yet creating actual utility proves harder than issuing tokens. Many crypto projects promise real-world applications but deliver trading speculation instead. World Liberty Financial needs to execute flawlessly here. Otherwise, these announcements become empty hype.

The company’s existing products show mixed results. Their WLFI token launched in September but has experienced significant price volatility. Meanwhile, their USD1 stablecoin grew rapidly to become the world’s fifth-largest, hitting $2.7 billion market cap.

Stablecoin Growth Raises Questions

USD1’s explosive growth looks impressive on paper. The stablecoin claims full backing by short-term U.S. government treasuries. That should make it stable and trustworthy.

But June data revealed concerning patterns. More than half of USD1’s liquidity came from just three wallets. That concentration suggests limited real demand beyond a few major holders.

Centralized exchange adoption remained muted too. Most USD1 volume happened on decentralized exchanges instead. For mainstream adoption, the stablecoin needs broader distribution across major trading platforms.

World Liberty Financial announced Wednesday that USD1 would launch on Aptos blockchain. Witkoff promised additional Asian partnerships soon. Expansion across multiple chains helps accessibility. Yet it doesn’t address the concentration concerns.

Trump Brand Meets Crypto Reality

President Trump’s crypto embrace has fueled World Liberty Financial’s visibility. His administration appointed crypto advocates to key positions. Bitcoin prices jumped 80% over the past year, partly due to regulatory optimism.

Trump himself launched $TRUMP, a meme coin separate from World Liberty Financial. That move attracted intense scrutiny. Opposition lawmakers accused the president of conflicts of interest and self-dealing. Calls for ethics investigations followed.

Trump Jr. tried addressing these concerns at Token2049. He insisted World Liberty Foundation operates independently from political aims. Instead, he framed USD1 as supporting American interests.

“We’re flying to every single corner of this globe, convincing people to onboard to USD1 which, in effect, convinces those people to go buy U.S. Treasuries,” Witkoff said. That ties the stablecoin directly to dollar hegemony and government debt markets.

The argument holds some merit. Stablecoins backed by U.S. treasuries create demand for government debt. But the optics remain problematic when the president’s family profits from promoting these products.

Competitive Landscape Looks Brutal

World Liberty Financial faces established giants in both product categories. Crypto debit cards already exist from Coinbase, Crypto.com, and Binance. These companies spent years building infrastructure and merchant partnerships.

The stablecoin market proves even more crowded. Tether’s USDT dominates with over $100 billion market cap. Circle’s USDC ranks second at roughly $50 billion. Both have regulatory relationships and mainstream adoption that USD1 lacks.

Breaking into these markets requires more than Trump branding. User experience, merchant acceptance, and regulatory compliance all matter enormously. World Liberty Financial must execute perfectly across all three areas.

Moreover, the company’s treasury strategy raises eyebrows. In August, World Liberty announced that ALT5 Sigma would buy $750 million worth of WLFI tokens. In exchange, World Liberty received ALT5 shares. That deal props up token prices artificially while concentrating ownership.

What Actually Matters Here

These announcements represent crypto’s ongoing struggle for legitimacy. The industry needs real utility beyond speculation. World Liberty Financial’s products target that exact problem.

The debit card could normalize crypto spending. Commodity tokenization might democratize access to traditionally exclusive markets. Both ideas hold genuine promise if executed well.

Yet the Trump connection complicates everything. Regulatory scrutiny will be intense. Critics will question every decision. Success requires not just good products but impeccable execution and transparency.

Most crypto projects fail to deliver on ambitious promises. World Liberty Financial needs to beat those odds while navigating unprecedented political scrutiny. That’s a tall order even with presidential backing.

The next six months will reveal whether this crypto venture offers real innovation or just trades on the Trump name. Pilot programs and partnerships will show actual adoption rates. Until then, skepticism remains warranted despite the bold announcements.