President Trump’s potential appointment of Kevin Hassett as Federal Reserve Chair just changed everything. Paired with Treasury Secretary Scott Bessent, this duo signals a fundamental shift in how America manages money, debt, and growth.

Financial markets are reacting. Bitcoin bulls see rocket fuel. Bond investors see danger. And economists see something we haven’t witnessed in decades: total coordination between the Treasury and the Fed.

This isn’t just another policy tweak. It’s a complete rewrite of the rules.

The Bessent-Hassett Playbook Breaks All the Old Rules

Central bank independence used to be sacred. The Fed made decisions separate from political pressure, focusing purely on price stability and employment.

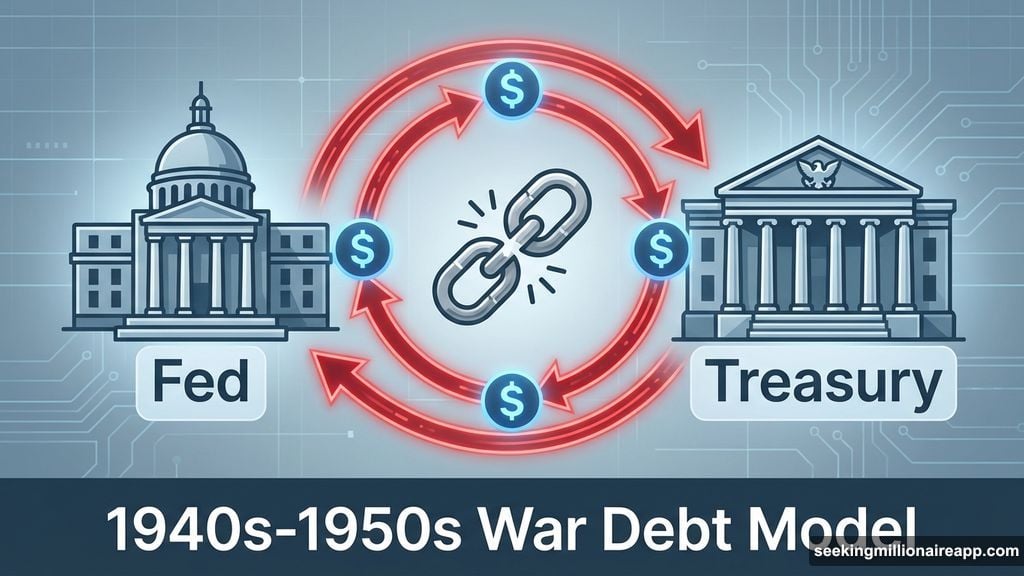

That framework is dying. If Hassett gets confirmed, the new approach resembles the 1940s and 1950s, when the Treasury and Fed worked hand-in-hand to manage war debt. But this time, the war is against a $34 trillion debt mountain that can’t be paid down through traditional means.

“You cannot shrink a debt load this large without blowing up the system,” market analyst Sight Bringer explained on X. “You can only outgrow it or inflate it away.”

So the strategy becomes clear. Coordinate fiscal spending with monetary expansion. Keep interest rates low enough to support growth. Let inflation run slightly hotter than comfortable. Meanwhile, weaken the dollar to boost exports and reshoring of manufacturing.

For Bitcoin, this creates perfect conditions. Expanded liquidity, lower real rates, and inflation concerns historically drive investors toward scarce assets. Plus, a weaker dollar makes Bitcoin more attractive to international capital seeking dollar-hedge exposure.

Growth Targets That Sound Impossible Just Got Serious Backing

Treasury Secretary Bessent recently predicted 4% GDP growth for the first quarter of 2026. That’s not a conservative estimate. That’s aggressive optimism backed by tax policy changes and consumer spending momentum.

Meanwhile, Hassett has been called “stupidly, cartoonishly bullish” on Bitcoin and stocks by crypto insiders. His track record shows consistent support for risk assets and accommodative monetary policy. Industry analysts describe him as a “turbo dove” who will prioritize growth over traditional inflation concerns.

This matters because Fed chairs shape market expectations. Even before making decisions, their known biases influence how investors position portfolios. If Wall Street believes Hassett will cut rates aggressively and expand liquidity, they’ll front-run those moves by buying risk assets now.

Bitcoin becomes an obvious beneficiary. Already positioned as “digital gold” and an inflation hedge, BTC thrives in environments where fiat currency devaluation accelerates. Add in potential strategic Bitcoin reserve discussions from the Trump administration, and you’ve got multiple tailwinds converging at once.

Short-Term Reality Check: Liquidity Isn’t Flowing Yet

Before everyone rushes to buy Bitcoin, there’s a timing problem. Near-term liquidity conditions don’t match the long-term bullish narrative.

Banking sector reserves are tightening. Fiscal spending is slowing from 2023-2024 peaks. Tariffs and lower interest payments to private creditors could temporarily reduce the money flowing through the system. That creates choppy conditions even if the structural setup looks bullish.

Analyst Michael Nadeau warns that these dynamics might delay the expected risk-asset rally. Markets could face volatility through early 2026 before the policy coordination effects fully kick in. That means patience matters more than aggressive positioning right now.

Smart investors are watching liquidity indicators, not just policy announcements. The Federal Reserve’s balance sheet, reverse repo facility drawdowns, and Treasury General Account movements tell the real story about available capital. Until those metrics shift decisively, Bitcoin might struggle to sustain major breakouts despite positive long-term fundamentals.

Dollar Weakness Strategy Aligns Perfectly With Bitcoin’s Moment

Trump’s economic team reportedly wants a weaker dollar. That’s not secret conspiracy talk. It’s stated policy to make American exports more competitive, reduce imports, and encourage domestic manufacturing investment.

Lower interest rates support this goal naturally. If US yields fall relative to other developed markets, the dollar weakens as capital seeks better returns elsewhere. That makes American goods cheaper abroad and manufacturing more competitive domestically.

For Bitcoin holders, dollar weakness acts like a rising tide lifting all boats. BTC is priced in dollars globally, so as the dollar falls, Bitcoin’s dollar price rises mechanically. But more importantly, international investors seeking alternatives to dollar exposure increasingly view Bitcoin as legitimate portfolio allocation.

Sovereign wealth funds, pension systems, and corporate treasuries have already started exploring Bitcoin. If the Bessent-Hassett policy framework accelerates dollar decline, that exploration becomes adoption. The next wave of institutional buying could dwarf the 2020-2021 cycle.

Inflation Hedge Narrative Returns With a Vengeance

The bond market is already splitting from crypto on this appointment. Bond investors see Hassett’s potential rate cuts despite persistent inflation as deeply concerning. Fixed-income assets lose value when inflation runs hotter than yields, and coordinated Treasury-Fed policy prioritizing growth over price stability threatens bondholders directly.

Bitcoin’s inflation hedge story suddenly matters again. For two years, that narrative faded as inflation cooled and the Fed maintained restrictive policy. But if Bessent and Hassett deliberately let inflation run to inflate away debt burden, owning scarce assets becomes critical again.

Only 21 million Bitcoin will ever exist. That cap can’t change through policy coordination or political pressure. Compare that to a monetary framework explicitly designed to expand money supply, suppress real yields, and accept higher inflation as necessary cost of growth.

The contrast couldn’t be sharper. Traditional inflation hedges like gold already respond to these dynamics. Bitcoin’s digital nature, portability, and growing institutional acceptance position it as the modern alternative to 5,000 years of precious metal storage.

May 2026 Marks the Real Beginning

Hassett’s potential Fed chairmanship would start in May 2026. That’s the deadline savvy investors are watching. Current Fed Chair Jerome Powell’s term ends then, and if Hassett replaces him, policy shifts from talk to action.

Between now and May, markets will price in expectations. Bitcoin could rally on anticipation alone if traders believe the structural shift is real. But the real test comes when Hassett chairs his first Federal Open Market Committee meeting and signals actual policy direction.

Early 2026 might see continued choppiness as liquidity tightness persists. But by mid-2026, coordinated policy should start showing tangible effects. Fiscal spending would increase, monetary policy would accommodate growth, and liquidity conditions would improve dramatically.

That’s when the Bitcoin supercycle thesis gets tested. If Bessent-Hassett deliver on their growth-first, liquidity-friendly framework, Bitcoin could enter a multi-year bull run unlike anything the market has seen. The combination of policy support, institutional adoption, and retail FOMO would create explosive conditions.

What This Means for Your Portfolio

This setup demands strategy, not panic. Long-term bulls have reason for optimism. The macro framework increasingly favors Bitcoin as both inflation hedge and growth asset. Policy coordination between Treasury and Fed creates conditions historically associated with major Bitcoin rallies.

But timing matters. Short-term positioning should account for liquidity constraints and potential volatility through Q1 2026. Accumulation makes more sense than leverage right now. Building positions gradually while monitoring liquidity indicators provides better risk-adjusted returns than aggressive all-in bets.

Watch the Fed’s balance sheet closely. Track reverse repo facility usage. Monitor Treasury spending patterns. These data points reveal when liquidity actually starts expanding, not just when policymakers talk about it.

And remember: regime changes take time. Even if Bessent-Hassett represent a historic shift, markets need proof before sustained rallies develop. Patience and positioning beat speculation and leverage every time.

The pieces are aligning for something significant. Whether it’s a supercycle or just another bull market depends on policy execution and global macro conditions. But the setup looks increasingly favorable for anyone holding scarce assets in an era of deliberate currency devaluation.