No bank account? No problem. Trust Wallet just made it possible to walk into a retail store, hand over cash, and receive crypto directly in a wallet you fully control.

That’s a bigger deal than it sounds. For millions of Americans who live and earn in cash, the digital finance world has largely been off-limits. Trust Wallet’s new Cash Deposits feature is a direct attempt to change that.

The Unbanked Just Got a Direct Path to Crypto

Gig workers, service workers, and people in cash-heavy local economies have always faced the same wall. Most crypto platforms assume you have a bank account or a debit card. If you don’t, you’re simply locked out.

Cash Deposits knocks that wall down. Powered by Coinme, a licensed crypto infrastructure platform, the feature lets users load physical cash at over 15,000 retail locations across the United States. The money converts into digital assets — including stablecoins, BTC, and SOL — and lands directly in a self-custody Trust Wallet. No intermediary holds your funds once the transaction is done.

Felix Fan, CEO of Trust Wallet, put it plainly: “Millions of people in the U.S. earn and live on cash, yet most digital financial tools still assume all have a bank account or card. Cash Deposits is about meeting these users where they are.”

Self-Custody Changes Everything Here

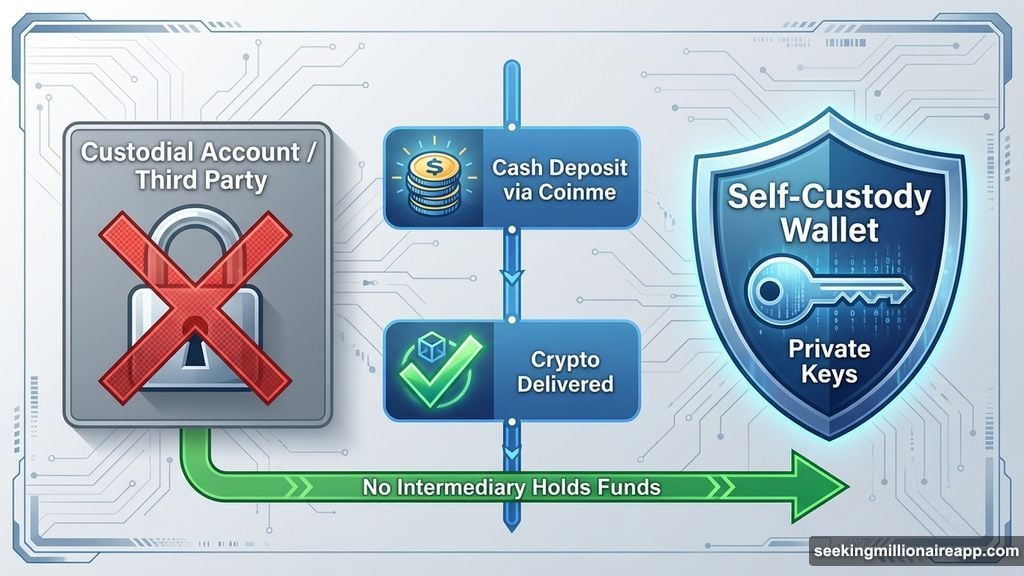

There’s a crucial difference between this and older cash-to-crypto services. Traditional options often funnel your money through a custodial account first, meaning someone else holds your funds temporarily, or sometimes indefinitely.

With Trust Wallet’s Cash Deposits, that middleman step disappears after the transaction completes. Your crypto goes straight into a wallet you control with your own private keys. That’s the self-custody promise, and it matters a lot for people who are already skeptical of institutions holding their money.

Neil Bergquist, CEO and co-founder of Coinme, explained the goal from his company’s side: “By powering Trust Wallet’s Cash Deposits feature, we’re enabling that infrastructure to operate seamlessly within a leading self-custody experience, making it simple for users to move from cash to crypto at scale.”

Also worth noting? Funds typically arrive within minutes, not days. For someone converting cash to send a remittance or pay for a service, that speed makes a real practical difference.

How the Feature Actually Works

The process is designed to be straightforward. Inside the Trust Wallet app, users can browse nearby retail locations that support Coinme’s cash deposit network before they even leave the house. Then they head to the store, deposit cash, and receive digital assets directly in their wallet.

Trust Wallet has over 220 million users globally, which gives this feature instant reach. The Cash Deposits rollout covers 48 U.S. states, plus Puerto Rico. New York and Vermont are excluded for now, and stablecoin purchases aren’t available in Texas.

Why This Launch Matters Beyond the Headlines

Think about what this combination actually represents. A person who has never interacted with the banking system can now participate in decentralized finance, send international remittances cheaply, hold stablecoins to protect against local inflation, or simply store value in digital assets they control.

That’s not a small thing. The unbanked and underbanked population in the United States is larger than most people assume. Federal Reserve data has consistently shown tens of millions of American households are underbanked or entirely without traditional accounts. Most crypto on-ramps have historically ignored this group entirely.

Plus, pairing Coinme’s nationwide retail infrastructure with Trust Wallet’s self-custody model creates something genuinely new: a mainstream, cash-to-stablecoin experience inside a single app, available at scale. That combination hasn’t really existed before in this form.

Whether this feature drives significant adoption will depend on how smoothly the retail experience actually works in practice, and whether fee structures make sense for lower-income users who need the service most. Those are real questions worth watching as the rollout matures.

But the direction is right. Financial tools that work for people without bank accounts aren’t charity projects. They’re just good product design for a user base that’s been overlooked for too long.