Switching between Ethereum and Solana used to mean juggling wallets, hunting for bridges, and hoping nothing breaks. That headache just disappeared.

Uniswap added native Solana support to its web app this week. Now traders can swap tokens across both ecosystems from one interface. No bridges required. No wallet switching. Just connect and trade.

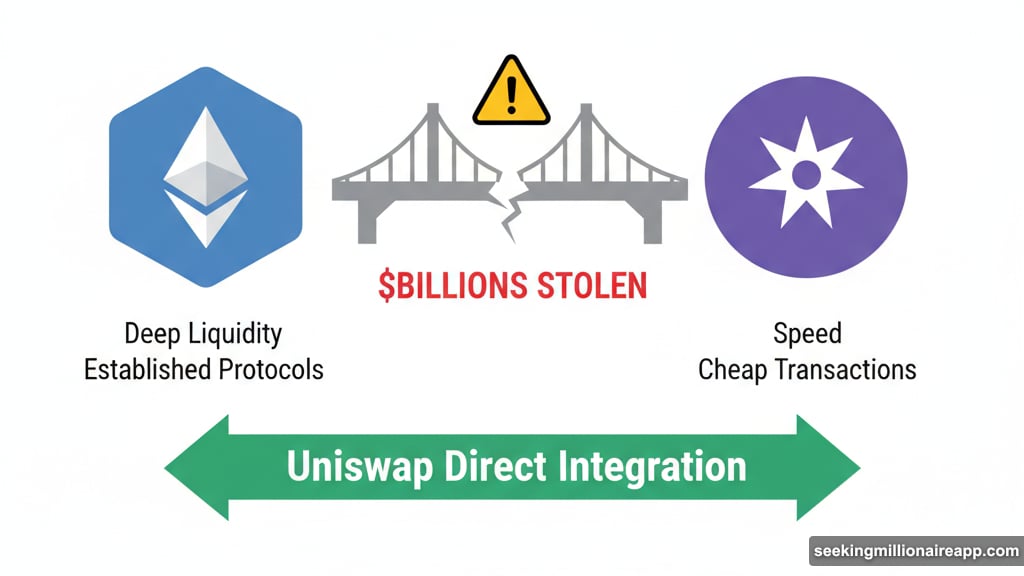

This matters because DeFi has been frustratingly split between two camps. Ethereum offers deep liquidity and established protocols. Solana delivers speed and cheap transactions. Until now, choosing one meant sacrificing the other.

The Fragmentation Problem Nobody Solved

DeFi grew fast but messy. Each blockchain built its own ecosystem. So traders who wanted exposure to both Ethereum and Solana faced real obstacles.

First, you needed separate wallets. MetaMask for Ethereum. Phantom for Solana. Remembering which wallet holds which tokens gets old fast.

Second, moving assets between chains required bridges. These cross-chain bridges add complexity, fees, and risk. Bridge hacks have stolen billions from DeFi users over the past few years.

Third, different interfaces for different chains meant learning multiple platforms. Each DEX works slightly differently. That learning curve kept casual traders stuck in one ecosystem.

Plus, tracking positions across multiple chains and wallets makes portfolio management a nightmare. You end up with assets scattered everywhere and no clear picture of your holdings.

What Actually Changed

Uniswap’s integration eliminates most of these friction points. The platform now supports Solana alongside Ethereum and 13 other chains.

Here’s what that means practically. Connect your Solana wallet directly to the Uniswap web interface. Browse Solana tokens the same way you would Ethereum assets. Execute swaps using the familiar Uniswap experience.

The backend routing handles the complexity. You just see one interface with access to both ecosystems. No manual bridging. No switching between different DEX platforms.

For context, Uniswap processes over $3.7 billion in daily trading volume according to DeFiLlama. That’s real liquidity now accessible to Solana traders without leaving their preferred interface.

Moreover, this works both ways. Ethereum users can now tap into Solana’s speed and low fees. Solana traders gain access to Ethereum’s deeper liquidity pools. Both sides benefit.

Why Solana Specifically Matters

Solana represents DeFi’s second-largest ecosystem after Ethereum. But the two communities barely overlapped until now.

Solana delivers transaction speeds Ethereum can’t match. Swaps settle in seconds rather than minutes. Plus, transaction costs stay under a penny most of the time. That makes small trades practical in ways Ethereum’s gas fees never allowed.

However, Solana still lacks Ethereum’s established liquidity depth. Many tokens simply don’t have Solana equivalents. Institutional players remain primarily on Ethereum.

So traders constantly faced this choice. Fast and cheap on Solana, or deep liquidity on Ethereum. Never both.

Uniswap’s integration changes that calculus. Now you can execute small trades on Solana to save on fees. Then move to Ethereum when you need serious liquidity for larger positions. All from one interface.

Besides, the psychological barrier matters too. New traders often stick with one chain because learning a second seems overwhelming. Removing that friction opens DeFi to less technical users.

The Technical Implementation

Uniswap isn’t deploying its protocol contracts directly on Solana. Instead, the web app integrates with existing Solana DEXs through aggregation.

Think of it as a unified frontend connecting to multiple backends. When you swap Solana tokens through Uniswap, the interface routes your trade to Solana-native DEXs. But you never leave the Uniswap web app.

This approach makes sense practically. Solana’s architecture differs significantly from Ethereum’s. Rewriting Uniswap’s contracts for Solana would take months and require extensive testing.

By aggregating existing Solana liquidity instead, Uniswap delivered this feature faster. Plus, users benefit from all available Solana liquidity, not just pools on a hypothetical Uniswap Solana deployment.

Still, this means you’re trusting additional layers in the stack. The Uniswap interface connects to Solana DEXs, which execute your trades. More moving parts mean more potential failure points, though major bugs seem unlikely given Uniswap’s track record.

What This Means for DeFi’s Future

Cross-chain integration represents DeFi’s next evolution. Single-chain maximalism made sense when each ecosystem stood alone. But as DeFi matures, users want access to everything without artificial barriers.

Other major protocols will likely follow Uniswap’s lead. Aave, Compound, and similar platforms could integrate multiple chains into unified interfaces. That would further reduce the friction between ecosystems.

However, true cross-chain DeFi still faces challenges. Liquidity remains fragmented even with better interfaces. Security concerns around bridges and aggregation layers persist. Plus, regulatory uncertainty around cross-chain protocols continues growing.

Yet the direction seems clear. DeFi’s future looks less like competing blockchains and more like an interconnected web. Users will choose based on needs for specific transactions, not lifetime commitment to one ecosystem.

Uniswap just pushed that future significantly closer. Whether other protocols match this integration speed determines how fast DeFi evolves beyond its current fragmented state.

The Risks Nobody Mentions

Adding Solana support isn’t pure upside. Several concerns deserve attention.

First, Solana’s network stability remains questionable. The chain has suffered multiple outages over the past few years. When Solana goes down, users can’t execute trades through Uniswap’s interface either.

Second, regulatory scrutiny might increase. Cross-chain platforms operating across multiple jurisdictions face complex compliance questions. So far, regulators haven’t figured out how to handle these hybrid platforms.

Third, security surfaces expand. More integrations mean more potential attack vectors. Each additional chain and bridge connection represents another possible vulnerability.

Finally, this could dilute Ethereum-focused development. If Uniswap diverts resources to supporting multiple chains, Ethereum-specific improvements might slow. That tradeoff matters for users primarily invested in Ethereum’s ecosystem.

Should You Actually Use This?

That depends on your trading style and risk tolerance.

For active traders moving between chains frequently, this integration saves significant time and hassle. Connect once, trade everywhere. The convenience alone justifies using it.

For HODLers rarely trading, the benefits matter less. You’re probably fine sticking with dedicated interfaces for each chain. No need to change your workflow dramatically.

For DeFi newcomers, Uniswap’s unified interface lowers the entry barrier considerably. Learning one platform beats juggling multiple DEXs across different chains.

But remember the risks discussed earlier. Network outages on Solana affect your ability to trade. Plus, regulatory uncertainty around cross-chain platforms could create future complications.

Test small amounts first. Connect your wallets, execute minor swaps, and verify everything works smoothly before committing serious capital. That’s just basic DeFi hygiene regardless of the platform.