The Office of the Comptroller of the Currency approved national trust charters for five crypto firms last week. Now traditional banks are fighting back hard.

The American Bankers Association and Independent Community Bankers of America fired off sharp criticism. They claim the OCC created a dangerous two-tier banking system that threatens financial stability. Plus, they want the approvals rescinded immediately.

This isn’t just industry rivalry. Banking groups argue the charters blur fundamental lines about what makes a bank trustworthy. And they say consumers will pay the price when things go wrong.

Five Crypto Firms Got Bank-Like Status

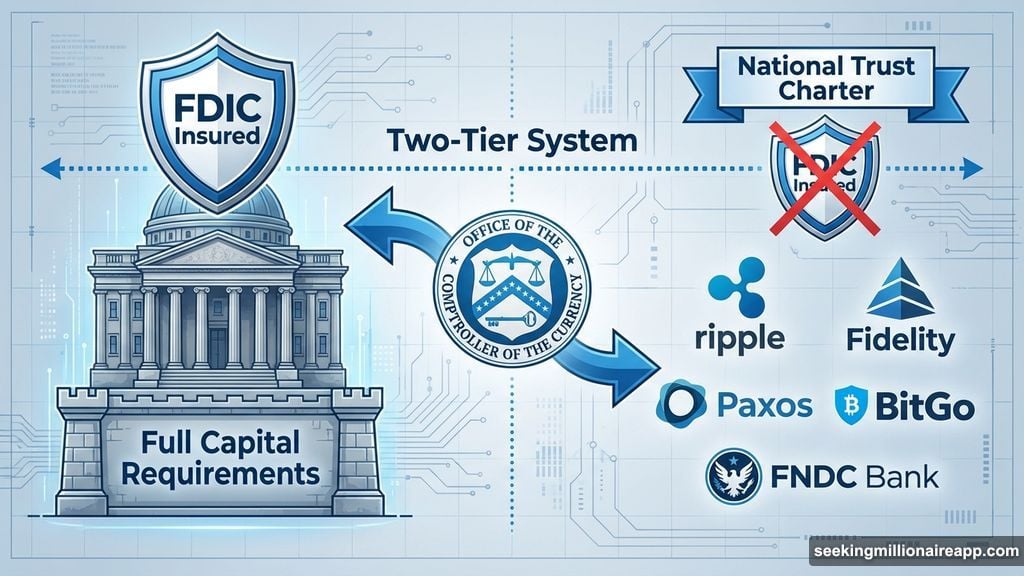

On December 12, the OCC conditionally approved national trust charters for Ripple, Fidelity, Paxos, First National Digital Currency Bank, and BitGo.

The regulator stressed these companies underwent rigorous review. Same process as traditional bank charter applicants, according to the OCC. So they earned their federal banking credentials through proper channels.

But here’s what has banking groups furious. These crypto firms get prestigious national charters without Federal Deposit Insurance Corp. coverage. Moreover, they don’t face the full capital and liquidity requirements that regular banks must meet.

That creates a fundamental imbalance. The crypto firms gain federal preemption of state money transmitter laws. Yet they dodge compliance obligations that apply to insured banks. Banking groups call this regulatory arbitrage at the federal level.

Banking Groups Say This Weakens The System

ABA President Rob Nichols didn’t mince words. He said the approvals “blur the lines” of what constitutes a bank.

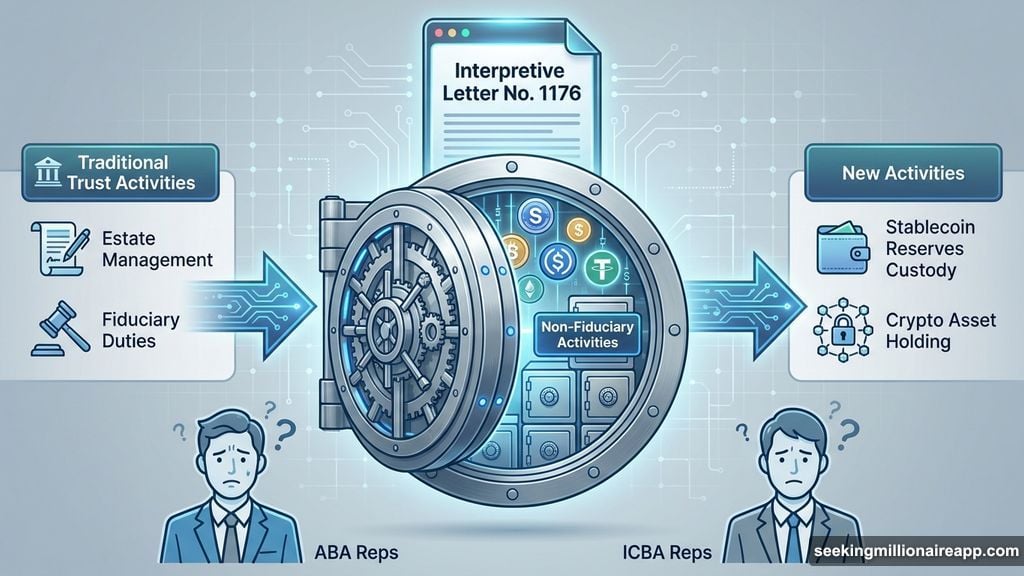

The core concern goes beyond competition. Banking groups warn that expanding trust powers to firms without traditional fiduciary duties creates institutions that look like banks but lack proper oversight. In fact, they argue this erosion weakens the integrity of the charter itself.

ICBA President Rebeca Romero Rainey pushed back even harder. She called the move a “dramatic policy change” that stretches the national trust charter beyond its historical purpose. Plus, she challenged the OCC’s legal authority to issue these charters at all.

The groups focused criticism on Interpretive Letter No. 1176. This guidance enabled trust banks to engage in non-fiduciary activities like custody of stablecoin reserves. Banking associations say that’s a departure from what trust companies traditionally do.

Consumer Confusion Creates Real Risk

Traditional banks worry consumers can’t tell the difference between insured banks and national trust institutions holding billions in uninsured crypto assets.

Here’s the problem. These crypto firms carry prestigious federal charters that signal legitimacy. But they lack FDIC insurance that protects depositors in traditional banks. So consumers might assume their assets enjoy the same protections when they don’t.

Banking groups also question how the OCC would manage failure of these entities. What happens if a firm holding billions in digital assets collapses? The OCC hasn’t explained its resolution process clearly.

Traditional banks argue the current framework could produce institutions the OCC isn’t equipped to resolve in an orderly way. And that leaves the broader financial system exposed. If a crypto charter holder fails spectacularly, traditional banks and their customers could face consequences.

Banking Groups Want Immediate Pause

Both the ABA and ICBA called for the OCC to halt and rescind the approvals.

They argue the charters create an inconsistent regulatory framework that threatens financial instability. Furthermore, they say the OCC needs to change course before these institutions become too big to manage safely.

The banking groups published their objections publicly through social media and official statements. “Just released – ABA statement on @USOCC’s announcement regarding national trust charters,” the American Bankers Association posted on X. Meanwhile, ICBA declared opposition to all five conditional approvals.

The groups emphasize this isn’t about blocking crypto innovation. Instead, they want regulatory consistency. If crypto firms want federal banking charters, banking associations argue they should meet the same requirements as traditional banks. That means FDIC coverage, full capital standards, and complete liquidity requirements.

What This Fight Really Means

This conflict exposes fundamental tension in how regulators approach crypto integration into traditional finance.

The OCC clearly wants to bring major crypto players under federal oversight. That makes sense from a regulatory perspective. Bringing these firms into the federal system theoretically increases transparency and accountability.

But banking groups argue the OCC is giving crypto firms the best of both worlds. They get federal legitimacy without federal-level consumer protections. And that creates systemic risk the banking industry will eventually have to absorb.

Neither side is backing down. The crypto firms secured conditional approval and will likely defend their charters vigorously. Banking groups, meanwhile, represent thousands of institutions and carry significant political weight. So this fight will probably escalate before it resolves.

The real question is whether Congress steps in. If banking groups convince legislators that the OCC exceeded its authority, new laws could reshape the entire framework. That would affect not just these five firms but the broader crypto industry’s path into regulated banking.

For now, watch how the OCC responds to these challenges. If the regulator defends its position, we’ll see more crypto firms seeking similar charters. But if banking groups succeed in forcing a pause, the path to federal crypto banking just got much harder.