Americans just got something they’ve wanted for years: leveraged spot crypto trading on exchanges that won’t vanish overnight.

On December 4, 2024, the Commodity Futures Trading Commission opened the door to margin-based spot crypto trading under federal oversight. For the first time, you can trade leveraged crypto on CFTC-registered exchanges with the same protections that have backed futures markets for nearly a century.

This changes everything. Previously, Americans wanting leverage had two choices: skip it entirely or risk using sketchy offshore platforms. Now there’s a third option that doesn’t involve praying your exchange stays solvent.

What Actually Changed

The CFTC just authorized spot crypto contracts to trade on registered futures exchanges. That sounds technical, but here’s what it means in practice.

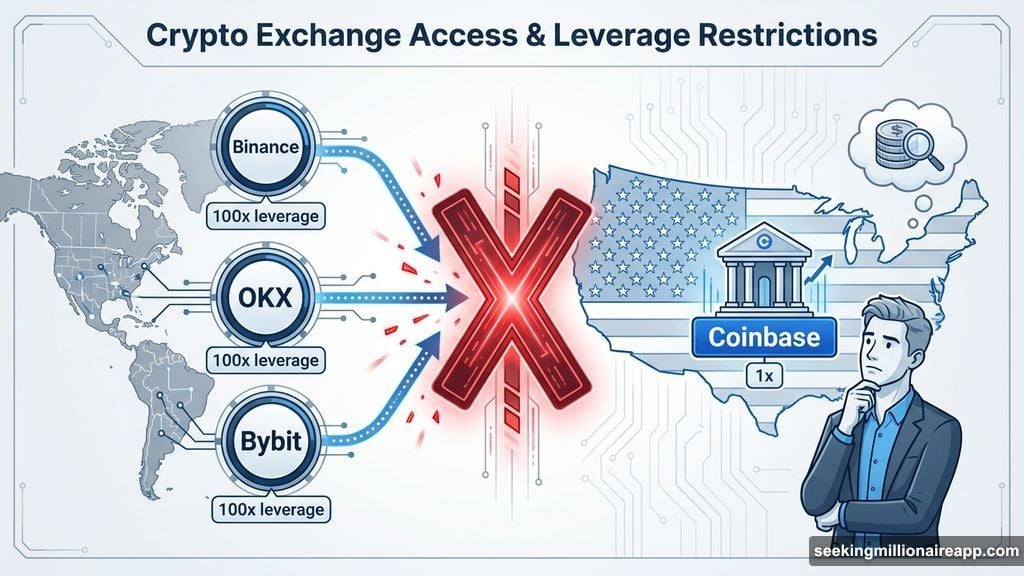

Before this, platforms like Coinbase offered spot trading without leverage. They operated under state money transmitter licenses. Good for basic buying and selling. Terrible if you wanted margin trading.

Now spot crypto gets the same treatment as futures and options. That means clearinghouse protection, standardized rules, and federal oversight. Plus, it eliminates the counterparty risk that has burned so many traders on offshore exchanges.

Bitnomial Inc. jumped first. They’re launching a CFTC-supervised leveraged retail spot crypto exchange on December 8. Their platform combines leveraged spot, perpetuals, futures, and options under one federally regulated roof.

“Leveraged spot crypto trading is now available under the same regulatory framework as U.S. perpetuals, futures, and options,” Bitnomial founder Luke Hoersten said. “Broker intermediation and clearinghouse net settlement eliminate counterparty risks while providing the capital efficiency traders need.”

Why Offshore Exchanges Dominated Until Now

Binance, OKX, and Bybit have captured billions in daily volume from American traders. They offered leverage ratios exceeding 100x on major cryptocurrencies. Meanwhile, US traders had zero domestic alternatives with comparable products.

The gap existed for years. Since 2017, Bitcoin and Ethereum futures and options traded on CFTC-registered exchanges. But leveraged spot? Nothing. So Americans either avoided leverage or took their chances with unregulated foreign services.

Acting CFTC Chairman Caroline Pham acknowledged this problem directly. “Recent events on offshore exchanges have shown us how essential it is for Americans to have more choice and access to safe, regulated U.S. markets,” she said.

Those “recent events” include exchange collapses, frozen withdrawals, and liquidity crises that wiped out trader accounts. Offshore platforms operate without the safeguards that define US financial regulation. When things go wrong, you’re on your own.

Clearinghouses Change the Risk Equation

Here’s the biggest deal about this move: clearinghouse protection.

A clearinghouse acts as the middleman for every trade. It guarantees both sides of the transaction. So if your counterparty defaults, the clearinghouse still pays you. This eliminates the counterparty risk that has plagued crypto trading since day one.

Offshore exchanges don’t offer this protection. You’re essentially trusting the platform to stay solvent and honor withdrawals. That trust has been repeatedly violated. FTX wasn’t an isolated case.

With clearinghouse settlement, your leveraged spot trade gets the same systemic risk reduction that traditional futures markets have used for decades. It’s not perfect protection. But it’s monumentally better than hoping an offshore exchange maintains proper reserves.

Legislative Push Supports Digital Assets

This regulatory progress didn’t happen in isolation. Congress passed legislation to clarify crypto rules and encourage domestic innovation.

The GENIUS Act, signed in July 2025, established the first federal framework for stablecoins. It requires 100% reserve backing and monthly public disclosures. The CLARITY Act followed soon after, creating tailored regulations for digital assets.

These laws represent a fundamental shift. The Biden administration focused on fraud prevention and money laundering controls. The Trump administration prioritized consumer protection while fostering innovation. The goal: position America as the global leader in digital assets rather than pushing the sector offshore.

The CFTC is also exploring tokenized collateral for derivatives margin requirements. That would let traders use stablecoins as collateral instead of just cash. However, the agency is proceeding carefully and seeking public feedback before implementing major changes.

Open Questions Remain

Despite the progress, critical details are still unclear.

Which cryptocurrencies qualify for leveraged spot trading? The CFTC hasn’t said. Will it be limited to Bitcoin and Ethereum, or will smaller altcoins get included? That distinction matters enormously for product appeal.

What leverage ratios will be allowed? Offshore exchanges routinely offer 100x leverage or higher. If CFTC-regulated exchanges cap leverage at 10x or 20x, many aggressive traders will stick with offshore platforms despite the added risk.

How will position limits work? The CFTC enforces strict position limits on futures contracts to prevent market manipulation. Will those same limits apply to leveraged spot? If so, institutional traders might find the products too restrictive.

These unanswered questions will determine whether domestic platforms can actually compete with established offshore exchanges. Regulatory safety matters. But if the products aren’t competitive, traders will continue risking offshore platforms.

Consumer Advocates Sound Warnings

Not everyone celebrates this development. Advocacy group Better Markets expressed concerns about potential confusion among retail investors.

They worry unclear guidance could mislead clients about which crypto assets and exchanges the new rules cover. Leveraged crypto trading remains extremely volatile. Retail investors might not fully understand the risks even with federal oversight.

Moreover, CFTC registration doesn’t eliminate market risk. It reduces counterparty risk and adds transparency. But you can still lose your entire position if the market moves against you. Leverage amplifies gains and losses equally.

Better Markets urged the CFTC to provide clear, comprehensive guidance to help retail investors understand exactly what protections they have and what risks remain. That’s a reasonable request given crypto’s volatility and the sector’s history of spectacular failures.

What This Means for US Crypto Markets

This move could shift significant trading volume from offshore to domestic platforms.

CFTC-registered exchanges offer legal certainty that offshore venues can’t match. They follow established rules on market manipulation, client fund protection, and position limits. These safeguards matter during periods of extreme market stress.

Institutional investors especially value regulatory compliance. Many have avoided crypto leverage entirely because offshore exchanges don’t meet their compliance requirements. Federally regulated alternatives remove that barrier.

However, retail traders have different priorities. They often prioritize product variety and leverage ratios over regulatory compliance. If domestic platforms can’t match offshore offerings, retail volume might not shift as dramatically as institutional volume.

The real test comes in early 2026. Will traders embrace CFTC-regulated platforms, or will they stick with familiar offshore exchanges despite the added risk? The answer depends heavily on product competitiveness and how quickly domestic platforms can scale.

The Bigger Picture

America just took a major step toward reclaiming its position in global crypto markets.

For years, unclear regulations pushed innovation offshore. Entrepreneurs built products abroad because they couldn’t get regulatory clarity at home. Traders used foreign platforms because domestic alternatives didn’t exist.

Now that’s changing. The CFTC provided a pathway for leveraged spot crypto under federal oversight. Congress passed legislation establishing clear rules for stablecoins and digital assets. The regulatory environment shifted from hostile to cautiously supportive.

This doesn’t mean crypto gets a free pass. The CFTC maintains strict oversight. Clearinghouses reduce risk but don’t eliminate it. Market volatility remains intense. Plus, we still don’t know critical details about which assets qualify and what leverage ratios are allowed.

But for the first time in years, Americans have a real choice. They can trade leveraged crypto on federally regulated exchanges with clearinghouse protection. Or they can continue using offshore platforms with higher leverage and higher risk.

That choice matters. It signals that America wants to lead in digital assets rather than cede the field to foreign competitors. Whether this regulatory framework succeeds depends on execution details we won’t see for months.