Crypto venture capital firms dumped over $2 billion into the industry in early 2026. But they’re not chasing the usual suspects.

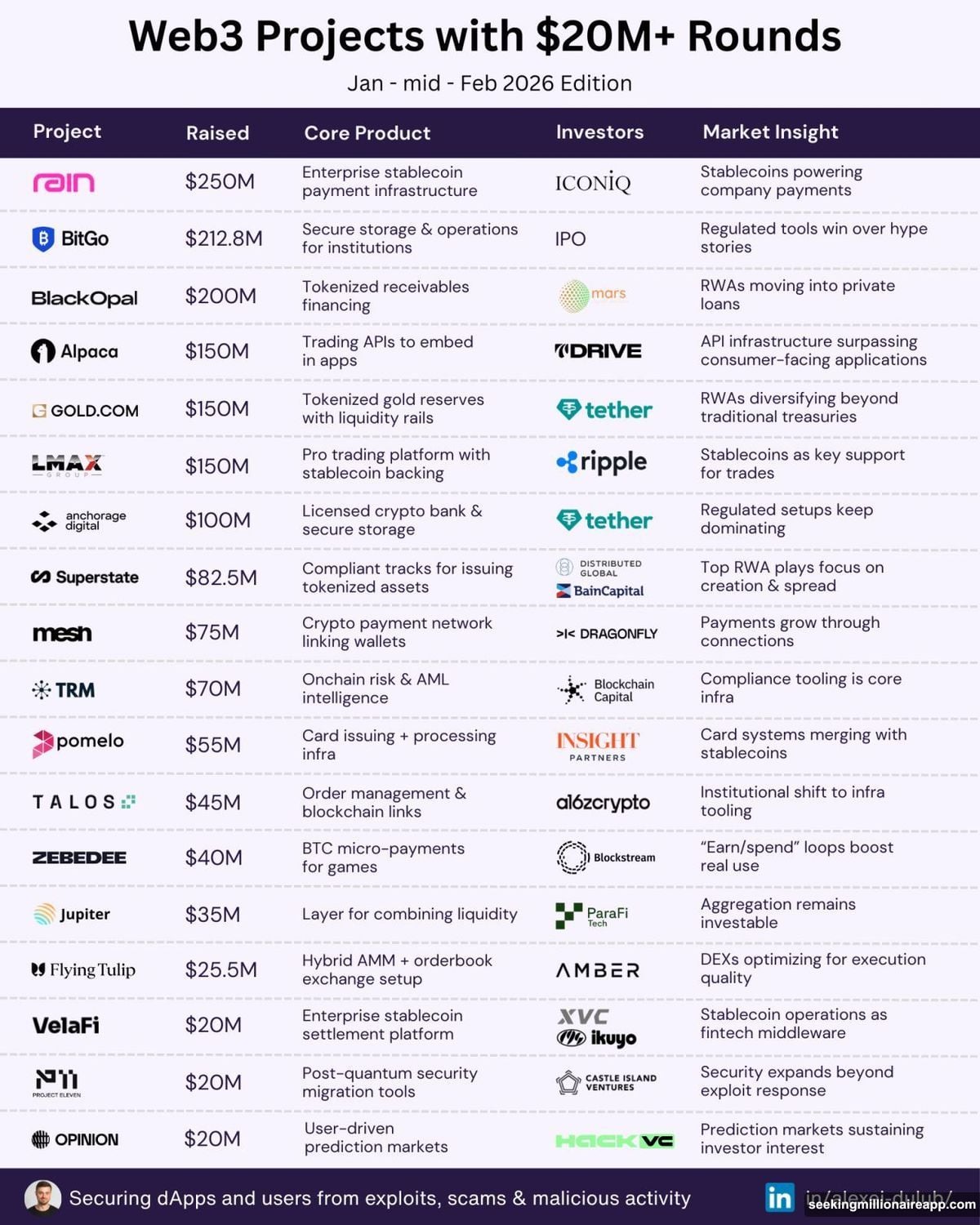

No Layer 1 blockchains. No meme coins. No AI-crypto mashups. Instead, VCs are backing infrastructure that feels almost boring compared to past cycles. Plus, that tells you something important about where crypto’s actually heading.

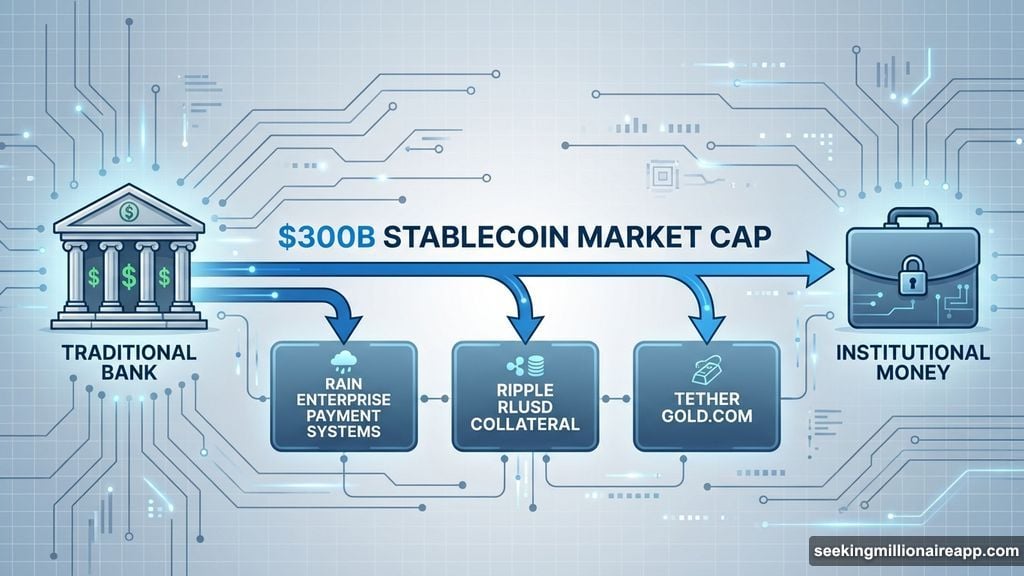

Stablecoin Rails Get the Biggest Checks

Rain raised $250 million to build enterprise stablecoin payment systems. That’s the largest single funding round so far this year.

Why stablecoins? The market cap stayed above $300 billion even while total crypto value dropped by $1 trillion. That stability attracts institutional money. Companies need reliable payment rails, not volatile tokens that swing 20% overnight.

Meanwhile, Ripple invested $150 million in LMAX trading platform. The deal integrates RLUSD as core collateral for institutional trades. So major players are betting on stablecoin infrastructure becoming the backbone of crypto finance.

Tether also dropped $150 million into Gold.com. The move expands access to both tokenized and physical gold. Clearly, the stablecoin giants see precious metals as the next frontier for tokenization.

Custody Services Finally Get Respect

BitGo secured $212.8 million through its IPO. The company provides digital asset custody and security for institutional clients.

Custody sounds unglamorous. But institutions won’t touch crypto without secure storage solutions. BitGo’s massive raise proves VCs understand this reality.

Security concerns killed institutional adoption for years. Now that problem’s getting serious capital. Furthermore, regulatory pressure makes proper custody non-negotiable for any firm handling client crypto assets.

The shift reflects a harsh truth. Retail investors obsess over token prices. Institutions care about infrastructure that prevents $100 million losses from hacked wallets.

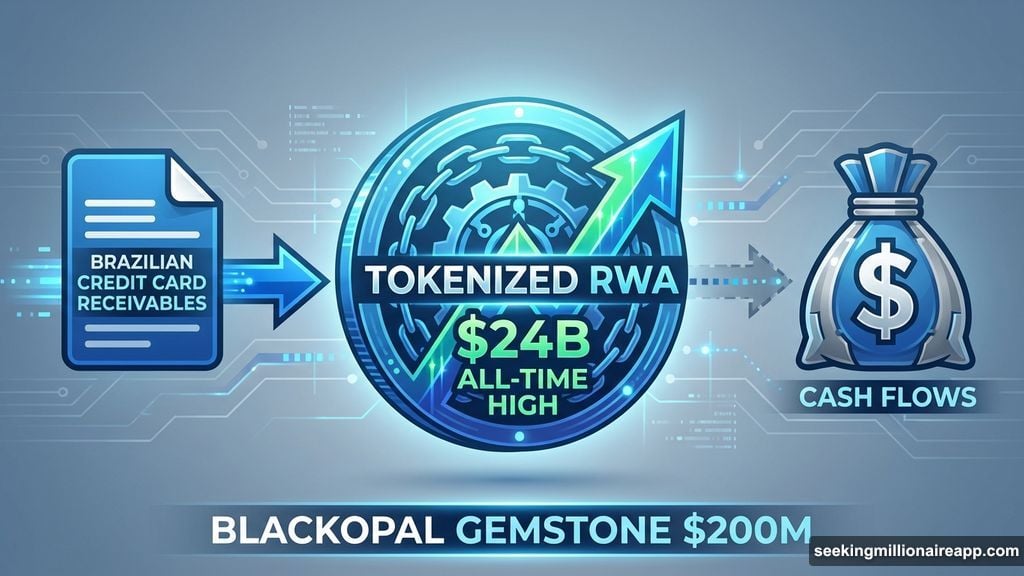

Real-World Assets Hit All-Time Highs

BlackOpal raised $200 million for GemStone. The product is an investment-grade vehicle backed by tokenized Brazilian credit card receivables.

Total tokenized RWA value reached $24 billion. That’s an all-time high achieved while the broader crypto market bleeds. In fact, RWAs are one of the few sectors showing actual growth right now.

Why the divergence? Real-world assets generate actual revenue. They’re not speculative tokens hoping someone pays more later. Brazilian credit card receivables produce cash flows regardless of Bitcoin’s price.

This matters because it proves crypto technology works beyond pure speculation. Tokenization provides real efficiency gains for traditional finance. Therefore, it attracts capital even during bear markets.

What Disappeared From VC Portfolios

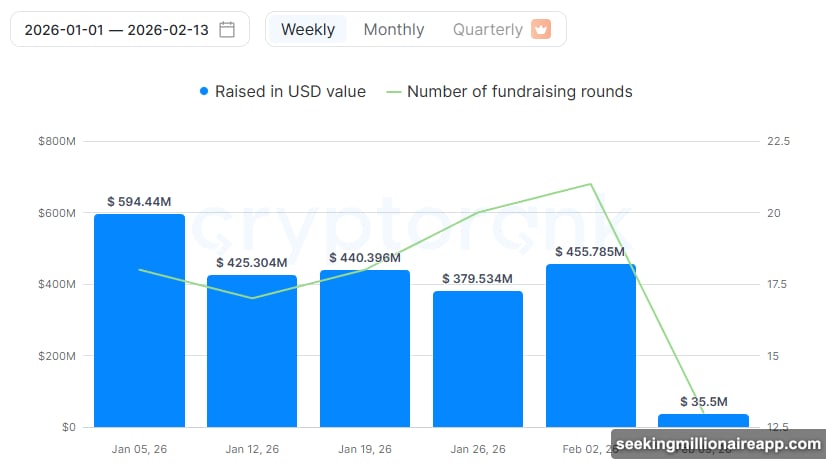

CryptoRank data shows weekly inflows averaging over $400 million. But the composition changed dramatically from 2021.

Layer 1 blockchains? Gone. Decentralized exchanges? Absent. Community-driven narrative projects? Nowhere in sight.

Ryan Kim from Hashed explains the shift. “In 2021, investors focused on tokenomics, community growth, and narrative-driven projects. By 2026, VCs will prioritize real revenue, regulatory advantages, and institutional clients.”

That’s a complete reversal. The industry used to celebrate projects with zero revenue but strong communities. Now VCs want profit-and-loss statements, regulatory compliance, and business customers.

Analyst Milk Road puts it bluntly. “Notice what’s absent? No L1s. No DEXs. No ‘community-driven’ anything. Every dollar went to infrastructure and compliance.”

This explains why retail investors feel frustrated. The projects getting funded won’t create FOMO or hype cycles. They’re building pipes and rails, not speculation vehicles.

The Bear Market Argument

Not everyone sees this positively. Analyst Lukas argues crypto VC is collapsing based on declining limited partner commitments.

He points to warning signs. Mechanism and Tangent shifted away from crypto. Many firms are quietly unwinding positions. High-profile funds can’t raise new capital.

However, $2 billion in quarterly funding doesn’t signal total collapse. It suggests consolidation and maturation instead. The money’s just flowing to different sectors than before.

Moreover, infrastructure investments pay off during bull markets. Companies building custody solutions and payment rails capture massive value when retail returns. So positioning now might be smart timing.

What This Means for Retail Investors

VC funding patterns reveal which sectors have institutional backing. That matters because institutions move slower but bring vastly more capital than retail.

Stablecoins, custody, and RWAs won’t create 100x moonshots overnight. But they’re solving real problems that prevented mainstream adoption. Once those problems are solved, the next bull market could be different.

Think about it. If custody is secure, payments are instant, and real assets are tokenized, what’s stopping institutions from going all-in? Not much.

Yet the lack of hype means most retail investors ignore these sectors. They’re still chasing the next Dogecoin or Solana killer. Meanwhile, the infrastructure enabling the next cycle is being built with billions in VC funding.

The Industry Is Growing Up

This funding shift signals crypto’s integration with traditional finance. That’s good for long-term survival but boring for short-term traders.

Revenue matters now. Regulatory compliance matters. Institutional clients matter. These weren’t priorities in 2021. Now they’re the only priorities that attract serious capital.

So crypto isn’t dying. It’s just becoming less exciting for speculators and more useful for actual business operations. Whether that’s positive depends on what you want from crypto.

If you’re here for quick gains and community hype, this environment feels dead. If you’re here for legitimate financial infrastructure, things are finally getting interesting.

The $2 billion in VC funding tells the story. The pipes are being built. Whether anyone uses them depends on the next market cycle. But when retail returns, the infrastructure will be ready this time.