Ethereum’s co-founder just dropped a harsh truth bomb about prediction markets. The platforms everyone celebrated last year? Buterin says they’re building on quicksand.

His warning cuts deep. Prediction markets like Polymarket grabbed mainstream attention and massive trading volume. But according to Buterin, they’ve become gambling dens that exploit naive traders instead of serving their original purpose. Plus, he thinks the whole sector could collapse when the next bear market hits.

The Dopamine Problem Nobody Wants to Admit

Buterin didn’t mince words in his February 14 statement. He argued prediction markets have “over-converged to an unhealthy product market fit.”

What does that mean? These platforms now chase short-term crypto bets and sports gambling. Sure, that generates dopamine hits for users. But it delivers zero long-term value for society or information discovery.

The business model depends on what Buterin calls “naive traders.” These are speculators hunting quick payouts rather than managing real-world risks. So platforms effectively farm money from retail gamblers who make consistently bad predictions.

Here’s the uncomfortable part. Buterin says there’s nothing morally wrong with taking money from people with “dumb opinions.” However, relying on this revenue stream creates perverse incentives. Platforms start optimizing for attracting more naive traders instead of building useful information markets.

That strategy works great during bull markets when speculation runs hot. But when bear markets arrive and gambling fever cools? The whole ecosystem risks imploding.

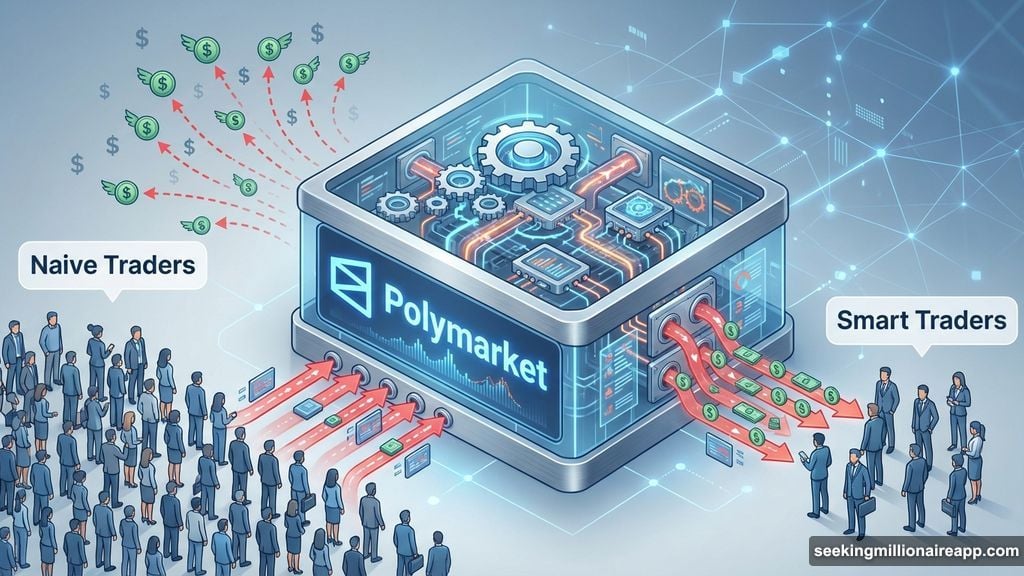

Smart Traders vs Money Losers

Buterin identified two distinct groups in current prediction markets. On one side sit “smart traders” who analyze data and make informed bets. On the other? “Money losers” who gamble on gut feelings.

Right now, the money losers are predominantly retail speculators. They provide liquidity and fees that keep platforms running. Yet this dynamic creates a fundamental problem.

If platforms keep prioritizing revenue extraction over societal utility, they’ll struggle to survive market downturns. The naive traders disappear when crypto prices crash. Meanwhile, smart traders can’t sustain markets alone because they need counterparties willing to take the other side of bets.

So the current model looks sustainable only during periods of irrational exuberance. That’s a terrible foundation for long-term infrastructure.

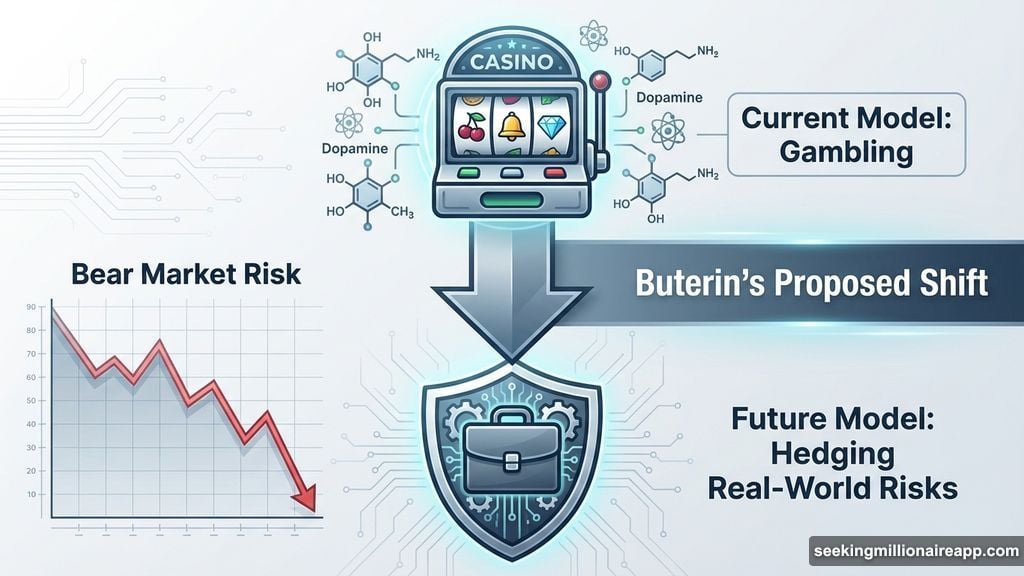

Hedging Instead of Gambling

Buterin proposed a radical shift. Prediction markets should transition from betting platforms to hedging mechanisms.

Think about the difference. Today, users bet on outcomes hoping to profit. Under Buterin’s vision, they’d take positions to offset real-world risks.

For example, a business owner might bet on policy changes that could disrupt their supply chain. If the policy passes, they lose money operationally but win on their prediction market position. That hedge offsets their real-world losses.

This approach transforms prediction markets from casinos into insurance tools. Users aren’t chasing dopamine hits. Instead, they’re protecting themselves against specific risks they actually face.

Moreover, this model doesn’t depend on naive traders. Both sides of each bet have legitimate hedging reasons to participate. So the ecosystem becomes self-sustaining even during bear markets.

The AI-Powered Fiat Replacement

Buterin’s recommendations went beyond fixing current problems. He sketched a long-term vision where prediction markets replace fiat-pegged stablecoins entirely.

Here’s how it would work. Platforms create detailed price indices covering major categories of goods and services globally. Then users employ local AI models to analyze their personal spending patterns.

The AI constructs a customized “basket” of prediction market shares that mirrors each user’s specific cost of living. By holding these shares instead of USDC or USDT, people theoretically maintain purchasing power against inflation without traditional banking infrastructure.

Buterin argued this system eliminates the need for fiat currency altogether. Users hold ETH or stocks to grow wealth. When they want stability, they shift into personalized prediction market baskets tailored to their expenses.

It’s a fascinating concept. Yet Buterin acknowledged the transition requires substantial new infrastructure. Moving from today’s “info buying” phase to an advanced hedging economy won’t happen overnight.

The Uncomfortable Question

Buterin’s critique raises an issue most prediction market proponents avoid. Are these platforms building useful infrastructure or just creating socially acceptable gambling?

The current trajectory suggests the latter. Platforms optimize for engagement and volume rather than information quality. They market themselves as wisdom-of-crowds oracles while quietly depending on retail gamblers for revenue.

That contradiction can’t sustain itself indefinitely. Either prediction markets evolve toward genuine utility through hedging mechanisms, or they’ll remain niche gambling platforms that boom and bust with crypto market cycles.

Buterin clearly believes the sector needs to choose its path now. Because continuing down the current road leads to eventual collapse when naive traders disappear and platforms lose their revenue base.

His proposed solution—AI-powered personal hedging baskets—sounds ambitious. Maybe even unrealistic. But it addresses the core problem: prediction markets need sustainable economics that don’t depend on extracting money from speculators making bad bets.

Whether platforms take his advice remains uncertain. What’s clear is that Buterin identified a fundamental flaw in today’s prediction market design. The dopamine-driven gambling model works until it doesn’t. And when it fails, the entire experiment risks taking a massive step backward.

Post Title: Vitalik Buterin Just Called Prediction Markets a Dopamine Trap

SEO Title: Vitalik Buterin Warns Prediction Markets Face Collapse

Meta Description: Ethereum’s co-founder just dropped a harsh truth bomb about prediction markets. The platforms everyone celebrated last year? Buterin says they’re building on quicksand.