XRP just did something most people didn’t see coming. The sixth-largest cryptocurrency by market cap is escaping its home turf.

Hex Trust announced wrapped XRP (wXRP) that works across multiple blockchains. That means XRP holders can now use their tokens on Ethereum, Solana, and other networks without selling or swapping. Plus, it starts with $100 million in liquidity already locked in.

But here’s the weird part. Despite this massive expansion, XRP’s price barely moved. The token sits at $2.04 with just a 1% bump. So what’s really happening here, and why should anyone care?

What Wrapped XRP Actually Does

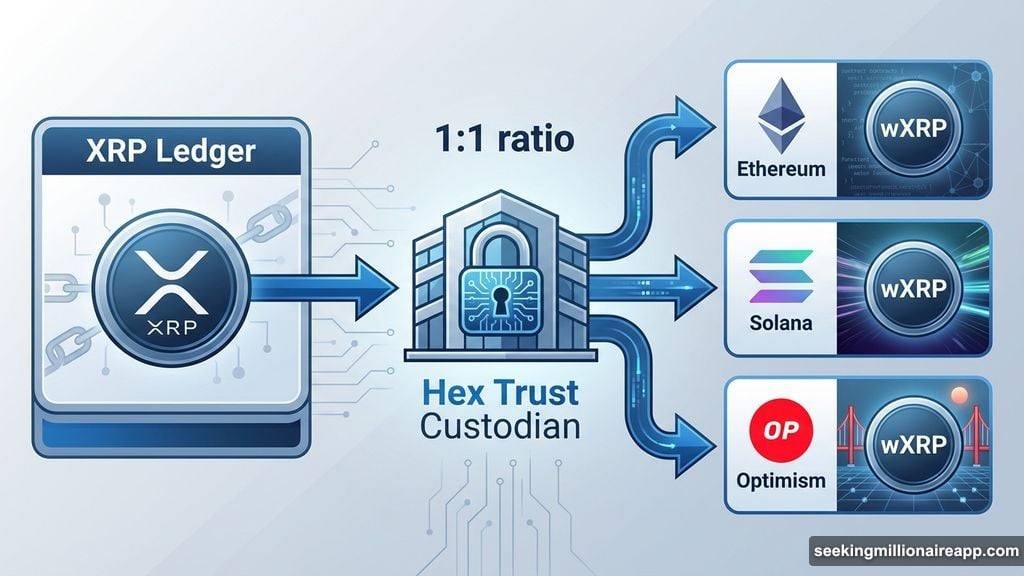

Think of wXRP like a gift card that works at different stores. You deposit real XRP with Hex Trust. They lock it up securely. Then they mint wXRP tokens on other blockchains at a 1:1 ratio.

Each wXRP represents one real XRP sitting in custody. Want your original XRP back? Burn the wrapped version. Hex Trust releases your native tokens. Simple as that.

The magic happens because now XRP can participate in DeFi protocols on Ethereum and Solana. Lending platforms, decentralized exchanges, liquidity pools—all suddenly accessible to XRP holders. Before this, using XRP meant staying on the XRP Ledger. That’s a pretty limited world compared to Ethereum’s massive DeFi ecosystem.

Giorgia Pellizzari, Hex Trust’s Chief Product Officer, explained that wXRP expands liquidity in DeFi and enables broader utility between XRP and RLUSD. Users get two compliant assets that work across supported blockchains.

Cross-Chain Without the Risk

Here’s where things get interesting. Most wrapped tokens rely on third-party bridges. Those bridges get hacked regularly. Billions stolen over the past few years.

wXRP sidesteps that problem. Hex Trust operates as a regulated custodian. They handle minting and redemption through authorized participants only. The process runs in a compliant framework with proper oversight.

Moreover, the wrapped token uses LayerZero’s Omnichain Fungible Token standard. That’s a fancy way of saying it’s built to work smoothly across multiple chains without creating security holes.

The initial launch covers Solana, Optimism, Ethereum, and HyperEVM. More networks will follow. Each one expands where XRP holders can deploy their assets without exposing themselves to sketchy bridge operators.

Why XRP Price Didn’t Explode

So if wXRP is such a big deal, why did the price barely budge? Markets are weird sometimes.

First, XRP already has massive liquidity. It trades billions of dollars daily. Adding $100 million in wrapped form makes a splash, but not a tidal wave. The percentage increase in total available liquidity is relatively small.

Second, the market might be waiting to see actual usage. Announcements sound great. Real adoption takes time. Traders want to see DeFi protocols integrating wXRP before getting excited.

Third, XRP has been struggling for months despite positive developments. Spot ETF approvals didn’t pump the price. Ripple’s expansion efforts didn’t either. The token seems stuck in a range while other assets rally.

Markus Infanger from RippleX noted growing demand to use XRP across the broader crypto ecosystem and among institutions. He said Hex Trust is addressing that demand while fitting naturally with RLUSD work. Yet demand and price action don’t always align immediately.

The DeFi Angle Nobody Talks About

Here’s what most coverage misses. wXRP isn’t just about bridging blockchains. It’s about making XRP useful in ways it never could be before.

Want to borrow stablecoins using XRP as collateral? You can now do that on Ethereum lending platforms. Want to provide liquidity for XRP trading pairs on Solana DEXs? That’s suddenly possible too.

The XRP Ledger has its own DEX and features. But it’s isolated. Most DeFi innovation happens on Ethereum and its Layer 2s. Solana hosts some of the fastest-growing protocols. By bringing XRP to these networks, wXRP unlocks participation in the broader DeFi economy.

Plus, institutions care about this. Regulated custody through Hex Trust means compliance officers can check boxes. That matters when you’re managing hundreds of millions in assets. The compliant infrastructure reduces friction for institutional adoption.

What Happens Next

The $100 million in initial liquidity creates a foundation. But success depends on integration speed. Which protocols will add wXRP pairs first? How quickly will liquidity grow beyond the launch amount?

Solana’s official account tweeted excitedly about XRP coming to their network. That suggests the Solana community sees value in the integration. If major Solana DEXs like Raydium or Orca add wXRP pools with attractive yields, adoption could accelerate.

Ethereum presents a different opportunity. The DeFi ecosystem there is mature but competitive. wXRP will compete with dozens of other wrapped assets for attention. Building liquidity takes time and incentives. Yield farming programs might help jumpstart activity.

Also watch for additional blockchain integrations. Hex Trust said more networks will follow the initial four. Avalanche, Arbitrum, Base—each new chain expands the potential user base. More integrations mean more utility, which should eventually reflect in price.

The Bigger Picture for XRP

This move signals Ripple’s evolving strategy. For years, XRP focused on cross-border payments and financial institutions. That narrative is expanding.

wXRP positions the asset as a DeFi player. Combined with RLUSD (Ripple’s stablecoin), it creates an ecosystem of compliant tokens working across multiple blockchains. Banks might care about payments. But crypto users care about DeFi yields and liquidity.

The muted price reaction might actually be healthy. It suggests markets are becoming more sophisticated. Announcements don’t automatically pump prices anymore. Real utility and adoption drive value over time. wXRP provides a path to that utility, but the work is just starting.

Still, the irony remains. XRP expands to the most important DeFi networks, and the market shrugs. Maybe traders are exhausted from previous disappointments. Maybe they’re waiting for proof of concept. Either way, the infrastructure is now in place for XRP to do more than just sit on exchanges.

The question isn’t whether wXRP is technically impressive. It clearly is. The question is whether anyone will actually use it. And that answer won’t come from press releases. It’ll come from DeFi protocols integrating it, liquidity providers adding it, and traders actually swapping it. Give it a few months. Then we’ll know if this expansion was a game-changer or just another headline that faded into noise.