Ripple’s token just posted its worst day in years. The selloff was brutal, fast, and forced.

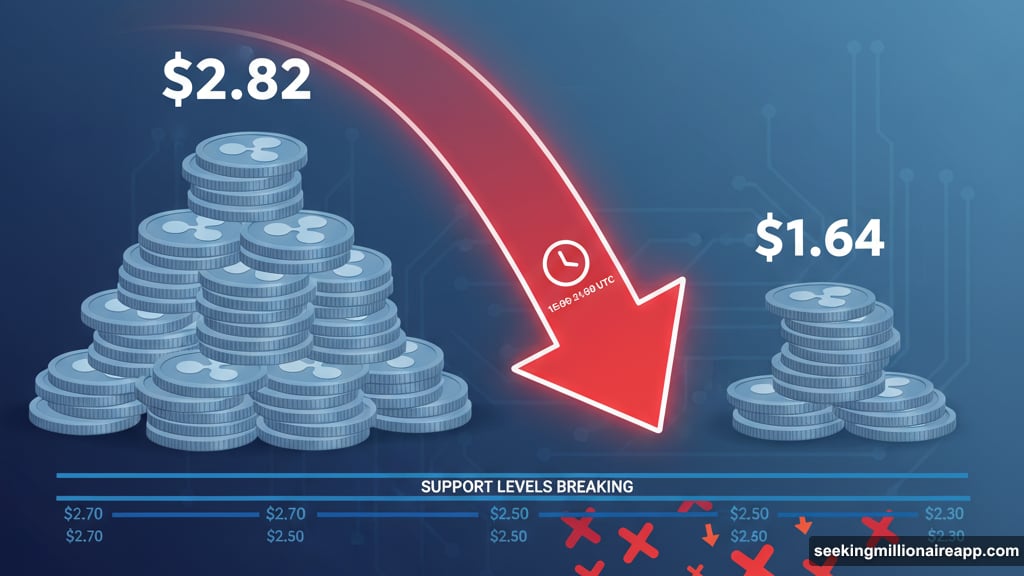

XRP plunged from $2.82 to $1.64 in hours before recovering to $2.36. That’s a 42% intraday drop. Trading volumes exploded 164% above the monthly average as liquidations cascaded across exchanges.

So what happened? Three factors collided at once.

Whales Dumped $150 Million in Futures

Institutional traders got caught long. Futures open interest collapsed from $9 billion to $8.85 billion as positions unwound.

The math tells the story. Long liquidations hit $21 million while shorts only took $2 million in losses. That’s a 10-to-1 ratio. Most market participants bet on continued upside. Instead, they got demolished.

Moreover, 320 million XRP tokens moved to exchange wallets over the past week. That’s distribution pressure from large holders. When whales sell into thin order books, prices collapse fast.

Peak volatility hit between 15:00 and 21:00 UTC. Hourly volume reached 817.6 million tokens during that window. Algorithms triggered cascading stop-losses as each support level broke.

Technical Support Zones Failed Completely

XRP breached every major support level in sequence. First $2.70 broke. Then $2.50. Finally, the token knifed through $2.30 before finding a floor at $1.64.

That low marked potential capitulation. Short-term holders who bought above $2 sold in panic. However, long-term holders stepped in below $2.40, creating a bounce.

The recovery to $2.36 happened fast. Final hour trading saw stabilization from $2.31 to $2.38 as algorithms detected value. But resistance formed immediately at $2.84.

Here’s the technical picture now. Support sits around $2.30-$2.35. Extended downside risk remains to $2.22 if buying dries up. On the upside, $2.84-$2.90 creates a ceiling. XRP needs to close above $2.90 to regain bullish structure.

Plus, the 75-day symmetrical triangle broke to the downside. That’s a bearish technical signal. RSI levels hit multi-month lows. Volatility bands expanded significantly.

Regulatory Uncertainty Spooked Traders

Timing matters. Ripple’s National Trust charter deadline passed on October 7 without resolution.

That creates uncertainty around XRP-linked institutional products. Banks and payment processors need regulatory clarity before committing capital. The delay adds risk premiums to XRP positions.

Additionally, macro headwinds intensified. Global trade tensions escalated. Central banks diverged on policy. U.S. digital banking license uncertainty grew. All of these factors weighed on risk assets like crypto.

The combination created perfect conditions for forced selling. Leveraged traders faced margin calls. Market makers widened spreads. Liquidity vanished when it mattered most.

What Happens Next

Three things determine XRP’s near-term path.

First, watch the $2.30 support zone. If whales accumulate here, price stabilizes. If they don’t, another leg down becomes likely. On-chain data shows some long-term holders adding below $2.40. That’s encouraging but not definitive.

Second, monitor futures open interest. The $150 million contraction needs to rebuild. Open interest growth signals renewed confidence. Continued decline suggests more pain ahead.

Third, track Bitcoin’s influence. BTC rallied to $125,000 recently. If that strength continues, money could rotate back into major altcoins like XRP. But if Bitcoin corrects, XRP faces additional downside pressure.

Regulatory news also matters. Any clarity on Ripple’s charter application or broader crypto banking rules would reduce risk premiums. Until then, institutional buyers stay cautious.

The Bigger Picture Nobody Mentions

This crash exposed how fragile crypto liquidity remains. A $150 million futures unwind triggered a 40% price collapse. That’s not a mature market. That’s a thin, leveraged casino.

Moreover, most retail traders lost money today. They bought near $2.80 based on momentum. They sold near $1.70 in panic. Meanwhile, sophisticated traders accumulated at lows and sold the bounce.

The lesson? Leverage kills. Position sizing matters. And crypto markets still lack the depth to absorb institutional-scale selling without violent price swings.

XRP might recover. The technology and partnerships remain intact. But today’s action shows how quickly sentiment shifts when whales exit aggressively.

Trade carefully. Size positions appropriately. The next cascade could happen anytime.