XRP just unlocked something it never had before. Real staking rewards.

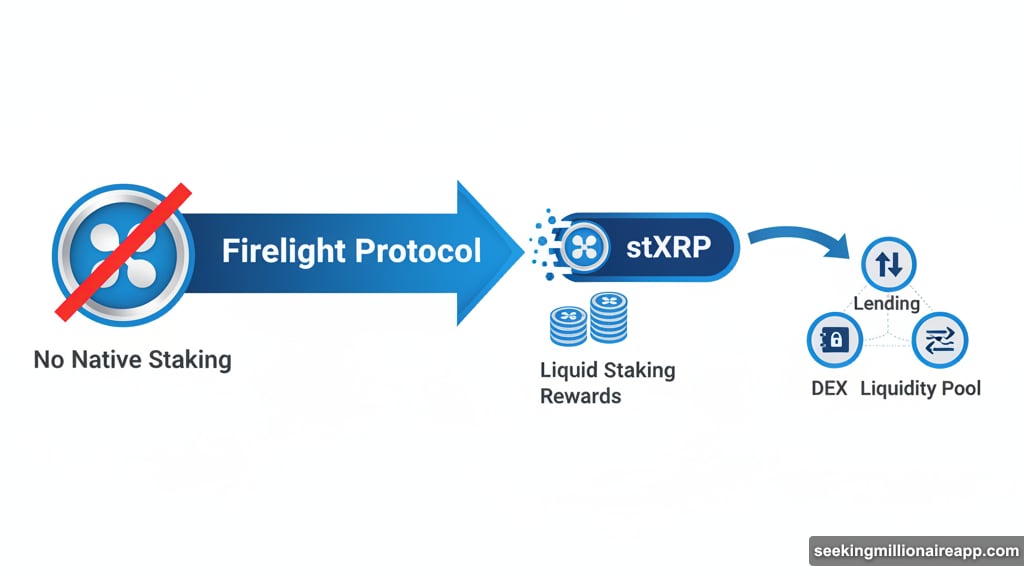

For years, XRP sat as one of crypto’s largest assets by market cap without any native yield opportunities. That changes now with Firelight Protocol, which launched a staking layer that puts your XRP to work. Plus, it does something more interesting than most staking systems: your staked assets help protect DeFi protocols from exploits.

Why XRP Needed This

Unlike Ethereum or Solana, XRP never offered staking. You could hold it. Trade it. But earning yield? That required risky third-party platforms or wrapping schemes that most people avoided.

Firelight changes the game. Now XRP holders can stake their assets and earn rewards while contributing to DeFi security. The protocol converts your XRP into stXRP, a liquid token you can freely trade or use across Flare’s DeFi ecosystem.

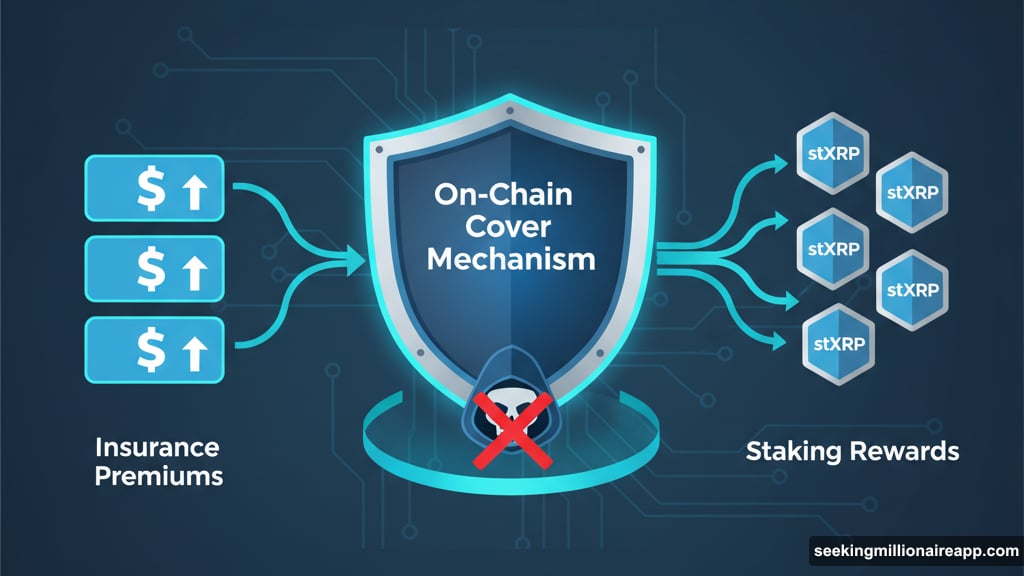

Here’s what makes it different. Your staked XRP doesn’t just sit idle earning inflation rewards. It backs on-chain insurance coverage for DeFi protocols. When platforms buy this coverage to protect against hacks, that demand drives rewards back to stakers.

DeFi’s $1 Billion Problem

DeFi just passed $170 billion in total value locked this October. Impressive growth. But here’s the ugly truth: protocols lose over $1 billion annually to hacks and exploits.

Traditional finance solved this decades ago with insurance embedded into every market. DeFi still lacks this critical protection layer. That gap scares away institutional capital that could push DeFi much higher.

Recent exploits like the Balancer hack remind everyone why security matters. Firelight tackles this problem head-on by creating an on-chain cover mechanism. Protocols can contract this coverage to safeguard assets. If an exploit happens, the cover kicks in to protect user funds.

That real demand for protection creates genuine utility for staked XRP. This isn’t artificial yield from token inflation. It’s revenue from protocols paying for actual security services.

How Firelight Works in Practice

The protocol launches in two phases. Phase one starts now.

You deposit XRP and receive stXRP tokens at a 1:1 ratio. These tokens represent your claim on deposited assets. But unlike locked staking, stXRP stays liquid. You can swap it on DEXs, use it as collateral in lending protocols, or add it to liquidity pools.

Early participants also earn Firelight Points. What those points convert to isn’t specified yet, but getting in early usually pays off in crypto launches.

Phase two activates the cover mechanism. That’s when staked XRP starts backing DeFi insurance. Protocols pay premiums for coverage, and those payments flow to stakers as rewards. The more demand for coverage, the higher your staking returns.

Security Built From the Ground Up

Firelight took security seriously from day one. Three separate audits by OpenZeppelin and Coinspect, plus a bug bounty program through Immunifi, vetted the protocol before launch.

The XRP bridge uses Flare’s FAssets system instead of generic bridges that often fail spectacularly. FAssets stays fully decentralized and went through extensive auditing. That matters because bridge exploits remain one of DeFi’s biggest risks.

This security-first approach makes sense given what Firelight does. You can’t build an insurance protocol on shaky infrastructure. The irony would be too much.

Backed by Serious Players

Sentora provides technical services while Flare Network enables the FAssets infrastructure. Both organizations have backing from Ripple itself, which adds credibility and resources.

Their combined expertise in secure interoperability and protocol design gives Firelight a strong foundation. This isn’t some anonymous team launching a protocol and hoping for the best. These are established players with reputations on the line.

That institutional support should matter to anyone considering where to stake their XRP. The difference between a protocol that survives and one that implodes often comes down to who’s backing it and why.

The Institutional Angle

DeFi’s recent growth surge came largely from institutional demand. Those players want exposure to decentralized finance, but they need institutional-grade security first.

Traditional finance won’t touch platforms without proper insurance and risk management. That’s where Firelight’s cover mechanism could prove crucial. If it works as designed, it removes a major barrier preventing traditional institutions from deploying serious capital into DeFi.

For XRP holders, that creates a compelling value proposition. Your staked assets help unlock institutional adoption, which could drive demand for coverage, which increases your staking rewards. Everyone wins if the flywheel spins correctly.

Real Utility or Marketing Hype?

Here’s my take. Firelight solves an actual problem that DeFi desperately needs fixed. The $1 billion annual loss to exploits isn’t made up. Protocols genuinely need better security infrastructure.

Whether Firelight becomes the dominant solution remains uncertain. Competition will emerge. Other projects will attempt similar approaches. But being first with strong backing and proper security audits gives them a real advantage.

The two-phase launch makes sense too. Get staking running smoothly first, then activate the cover mechanism once you’ve proven the system works. That’s smarter than launching everything at once and hoping nothing breaks.

My biggest question is pricing. How much will protocols pay for coverage? If premiums stay too low, staking rewards won’t attract enough capital. If they’re too high, protocols won’t buy coverage and the whole model fails. Finding that balance will determine if this succeeds or becomes another forgotten protocol.

XRP holders finally have a legitimate staking option. Whether it delivers sustained value depends on DeFi’s willingness to pay for the security it desperately needs.