Coinbase just burned through 870 million XRP tokens in three months. That’s not a typo.

The exchange dropped from 970 million tokens spread across 52 wallets down to just 99 million sitting in 6 wallets. Plus, this 90% supply crater happened while institutional demand exploded. So what’s really going on?

The Numbers Tell a Wild Story

Three months ago, Coinbase held nearly a billion XRP tokens across dozens of cold storage wallets. Now? That figure collapsed to 99 million across just six wallets.

On-chain data from XRPWallets confirms the dramatic shift. The exchange consolidated from 52 separate storage locations down to 6. That’s not normal wallet management. Something fundamental changed in how Coinbase handles XRP.

Meanwhile, XRP keeps a 100 billion token total supply. Yet despite that massive float, market watchers spot clear signs of a supply squeeze building.

Institutions Keep Stacking XRP

Eight companies now run XRP treasury strategies. They’re betting big on Ripple’s native cryptocurrency.

Trident Digital Tech Holdings leads the pack. VivoPower International follows close behind. Plus, Wedbush International joined the party. Each holds over $100 million worth of XRP tokens.

But that’s just the beginning. Eleven spot XRP ETF applications sit waiting for SEC approval. Major players filed those applications. Bitwise wants in. So does Grayscale, Fidelity, VanEck, Franklin Templeton, and ARK Invest.

The Rex-Osprey XRP ETF goes live this week under the ’40 Act structure. That adds even more institutional buying pressure. More demand, less supply available. Simple economics.

Real World Use Cases Keep Growing

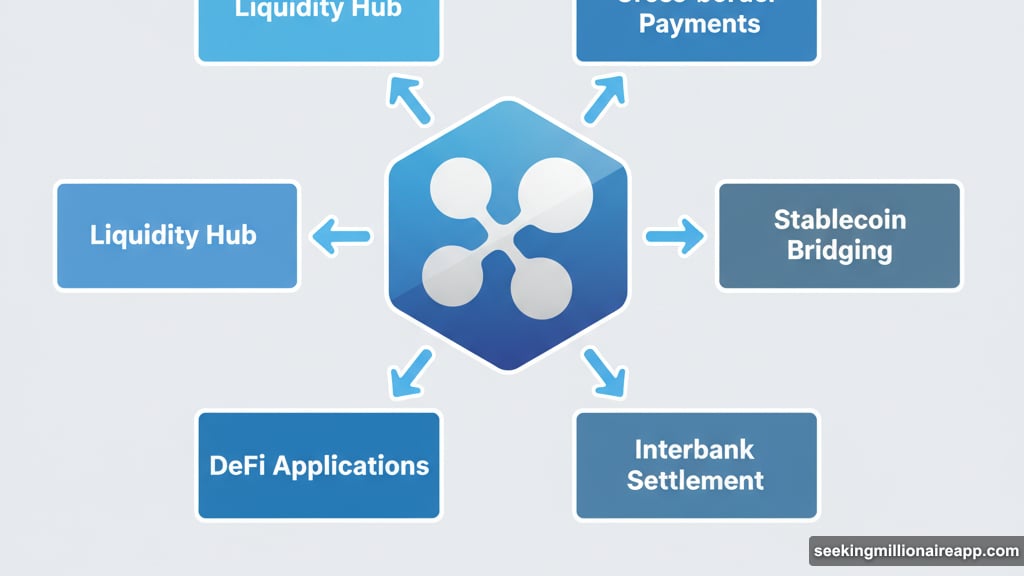

Beyond treasuries and ETFs, XRP faces surging utility demand across multiple sectors. Cross-border payments eat up tokens. Tokenized real-world asset settlement consumes more.

Stablecoin bridging needs XRP. Interbank settlement relies on it. Decentralized finance applications keep building on the network. Each use case locks up circulating supply.

That creates sustained demand pressure separate from speculative trading. The tokens get used, not just held.

Price Action Shows Strength

XRP reclaimed the $3.00 support level amid broader crypto market volatility. Daily trading volume jumped 12.47% to $5.7 billion.

Open interest data from Coinglass shows $8.57 billion locked in XRP positions. Traders aren’t backing away. They’re leaning in.

Crypto analyst Dark Defender sees his Elliott Wave analysis breaking bullish. XRP pushed through initial weekly resistance already. His Fibonacci projections target $4.39 next. Beyond that? $5.85 comes into view.

Downside support sits at $3.01 with secondary protection at $2.85. But momentum favors the bulls right now.

The Timing Raises Questions

Why did Coinbase slash holdings now? The exchange hasn’t publicly explained the 90% reduction.

Several theories make the rounds. Maybe institutional clients withdrew massive amounts for treasury positions. Perhaps the exchange moved tokens to different custody solutions. Or regulatory concerns triggered internal reorganization.

Whatever the reason, that much XRP doesn’t vanish without purpose. Someone wanted those tokens off the exchange. That typically signals long-term holding plans rather than active trading.

Supply Shock Economics

Markets run on supply and demand. When available supply drops 90% while demand surges, prices typically react violently upward.

XRP’s situation stacks multiple demand drivers simultaneously. Corporate treasuries buy continuously. ETF launches require token purchases. Real utility consumes circulating supply. Meanwhile, Coinbase holdings crater.

The math points one direction. Either supply returns to exchanges soon, or prices adjust higher to balance the equation.

What Happens Next

Dark Defender’s technical targets at $4.39 and $5.85 look conservative if supply stays tight. But markets rarely move in straight lines.

Expect volatility along the way. Resistance levels will test bulls multiple times. Profit-taking will trigger temporary pullbacks. Yet the underlying supply dynamics favor higher prices over time.

Watch open interest closely. Rising open interest with rising prices confirms genuine demand. Declining open interest during rallies warns of potential weakness.

Also monitor exchange reserves across all major platforms. If the Coinbase pattern repeats elsewhere, the supply shock intensifies. More platforms showing depleted XRP holdings strengthens the bullish case.

The XRP supply situation changed dramatically in just three months. Institutional demand keeps building while available tokens disappear from exchanges. That creates the classic setup for explosive price moves.

Whether XRP reaches $5 depends on how long supply stays constrained and how aggressively institutions keep buying. Right now, both trends favor the bulls. But crypto markets love surprises. Stay alert.