XRP is sitting in a dangerous spot right now. The price hovers around $1.89, just 1% above a critical support zone. On the surface, things look calm. But underneath, several warning signs are quietly stacking up.

What makes this setup particularly worrying isn’t just where XRP is trading. It’s what failed to happen when it should have bounced. That failure tells us something important about what comes next.

The Bullish Signal That Failed

Between December 31 and January 20, XRP printed a hidden bullish divergence on the daily chart. Price made a higher low while the RSI indicator made a lower low. This pattern usually signals that selling pressure is weakening and buyers are about to step in.

Normally, that leads to at least a short-term bounce. This time, it barely moved. Price stalled. Momentum never expanded. And buyers never showed up.

This kind of divergence failure is rare. It usually appears in weak markets where demand is missing entirely. When a bullish signal flashes and nobody acts on it, that’s a red flag.

So the real question becomes: if buyers didn’t step in after selling pressure eased, what happens when sellers return?

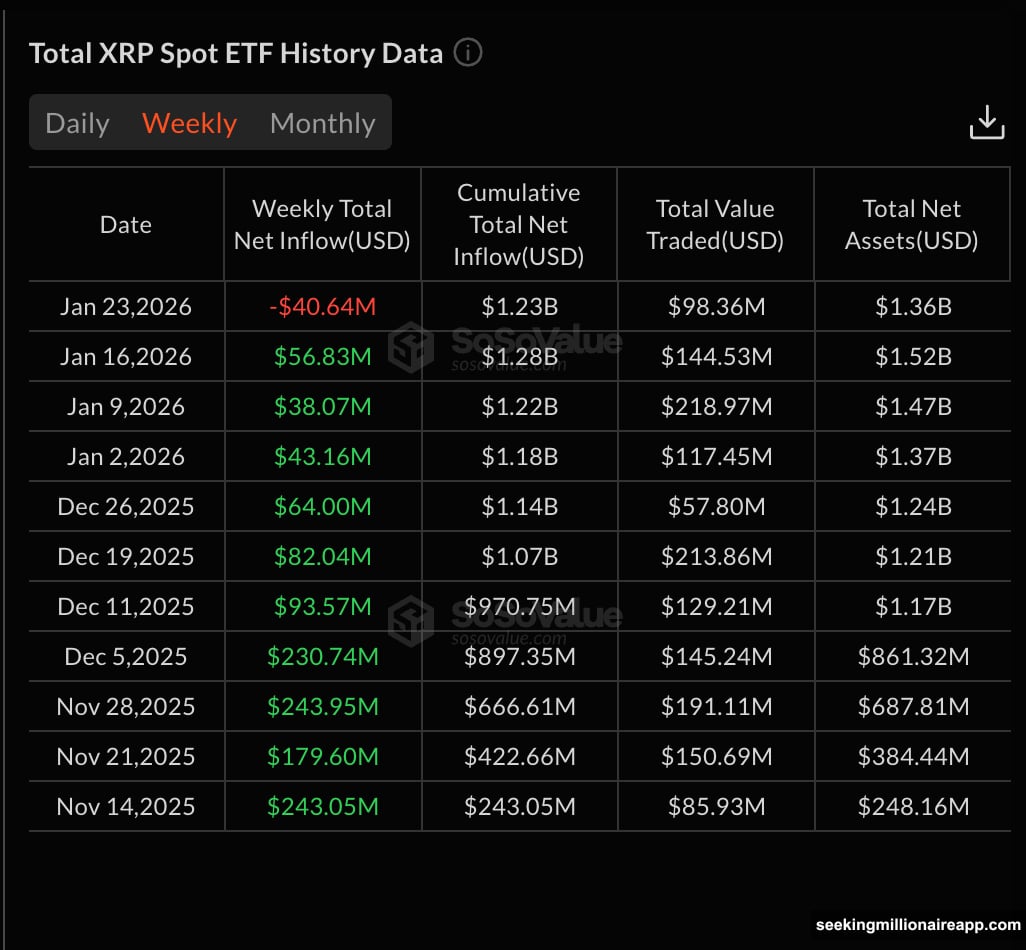

ETF Demand Dried Up Fast

The answer starts with capital flows. For the first time in weeks, XRP-related ETF products recorded net outflows. The week ending January 23 saw roughly $40.5 million leave the market. That came after a long stretch of steady inflows.

ETF flows matter because they reflect large, directional capital. When inflows stop and flip negative, it usually means institutional demand is pausing or stepping back entirely. And that’s exactly what just happened.

Plus, on-chain data confirms the same story. Long-term holders aren’t accumulating anymore. On January 20, they controlled about 232.1 million XRP. By January 24, that figure dropped to 231.55 million XRP.

This isn’t aggressive selling. But it’s definitely not confidence either. After the divergence flashed, long-term holders didn’t add meaningfully. They stayed on the sidelines while price struggled.

When ETF demand stalls and long-term holders pause at the same time, rebounds tend to struggle. That’s the situation XRP faces right now.

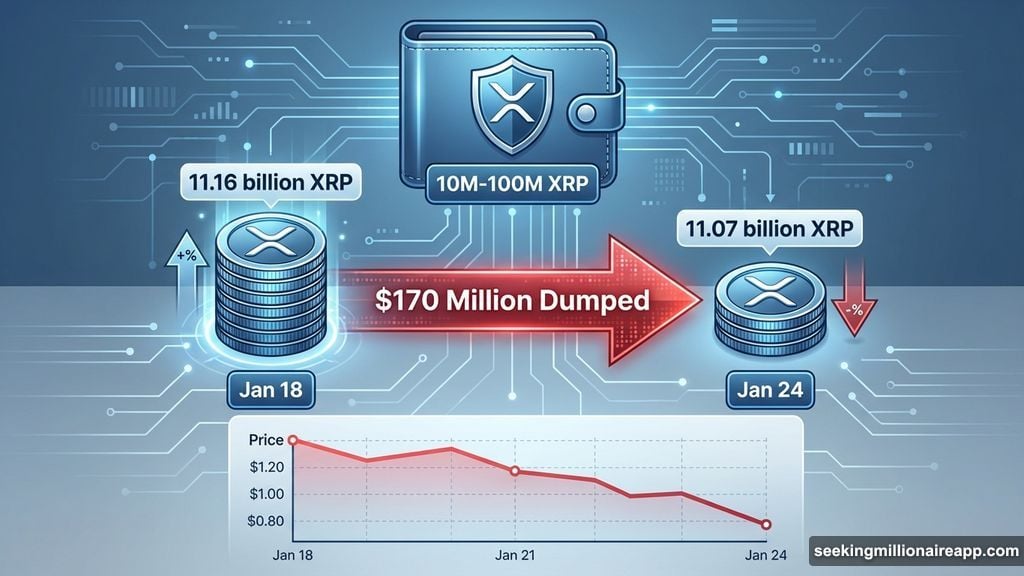

Whales Quietly Dumped $170 Million

While buyers hesitated, one group acted decisively. Wallets holding between 10 million and 100 million XRP began reducing exposure over the past week.

On January 18, this cohort held roughly 11.16 billion XRP. By the latest reading, their balance dropped to about 11.07 billion XRP. That’s a reduction of around 90 million XRP. At current prices, that represents roughly $170 million worth of distribution.

This selling pressure helps explain why XRP failed to react to the hidden bullish divergence. It also explains why price remains pinned near support despite technical signals suggesting relief was coming.

The imbalance is now obvious. Sellers exist. Buyers don’t.

The 25% Breakdown Zone Is Right Below

From a technical perspective, the risk is crystal clear. XRP is trading just above the $1.85 to $1.86 support zone. A daily close below that level would break wedge support and activate the downside target.

That opens the door toward $1.70 first. If momentum accelerates, the next stop is around $1.42. That would come close to a 25% drop from current levels.

On the upside, XRP needs to reclaim $1.98 to weaken bearish pressure. That would provide short-term relief. But without renewed buyer participation, it would likely remain a bounce rather than a trend shift.

Right now, all the pressure points downward. The failed divergence, weak ETF flows, flat holder positioning, and active whale selling all point the same direction.

What Happens If Support Breaks

Markets don’t usually break cleanly. They tend to grind until something gives. XRP has been grinding for weeks now. Price is compressed. Volume is fading. And the key support zone is just 1% below.

If $1.85 breaks, it likely happens fast. That’s how breakdowns work after long periods of compression. Sellers who stayed patient finally act. Stop losses trigger. And momentum feeds on itself.

The problem is that there’s no obvious buyer waiting below. ETF demand turned negative. Whales are distributing. Long-term holders aren’t adding. So who steps in to catch the move?

That’s the question nobody seems able to answer right now. And until someone does, the risk of a sharp move lower stays very real.

XRP is sitting on the edge. The next few days will decide whether support holds or whether the 25% breakdown scenario plays out. Based on the data, buyers need to show up soon. If they don’t, this gets ugly fast.