Exchange inflows just hit a four-week high. That’s the first major selling signal XRP holders have sent in a month.

Yet whale wallets quietly accumulated over one billion XRP this week. Someone’s betting big while everyone else heads for the exits. The question is whether looming ETF approvals can stop XRP from sliding below two dollars.

Retail Investors Hit the Panic Button

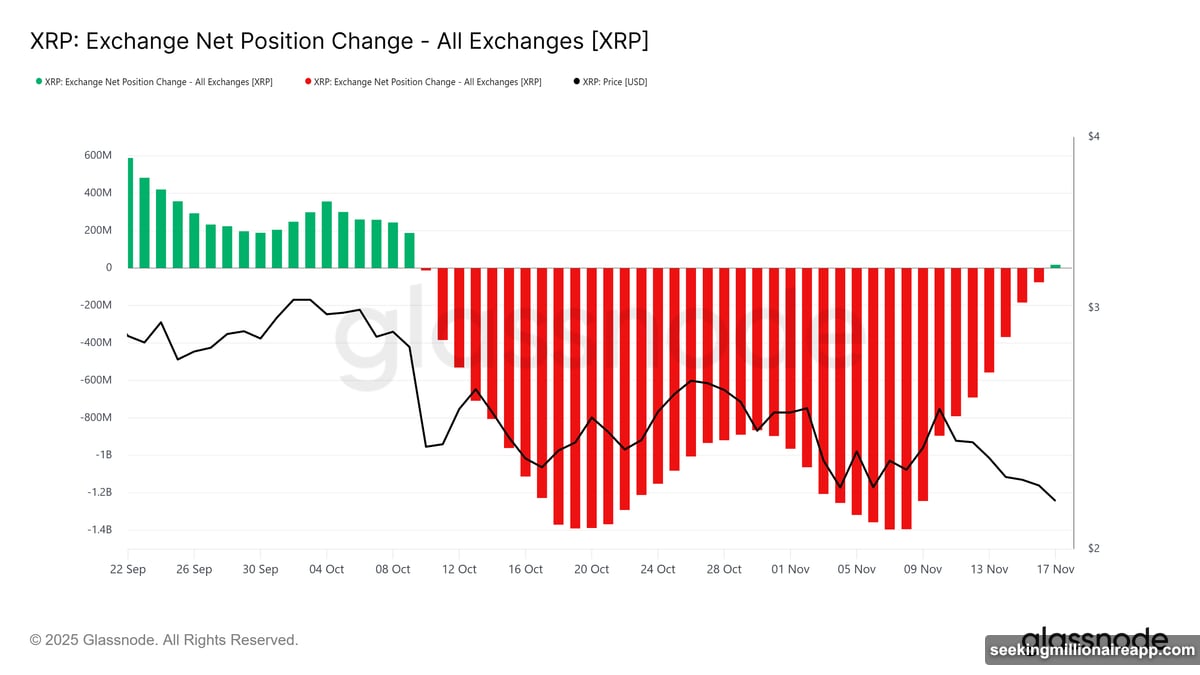

Exchange net position data flipped from outflows to inflows over the past 24 hours. For the first time in over a month, XRP holders are moving coins back to exchanges en masse.

That’s a classic bearish signal. When investors send tokens to exchanges, they’re usually preparing to sell. So after weeks of steady outflows that suggested growing confidence, this reversal indicates weakening conviction among retail holders.

The timing matters too. XRP has been grinding lower for nearly 30 days straight. Plus, the asset keeps testing support around the two-dollar level without finding sustained buying pressure. So retail appears to be cutting losses rather than buying weakness.

Moreover, this shift from outflows to inflows marks a meaningful change in market structure. Instead of accumulating and moving XRP into cold storage, holders are positioning for potential downside. That creates additional selling pressure right when the price needs support most.

Whales Scoop Up 1.1 Billion XRP

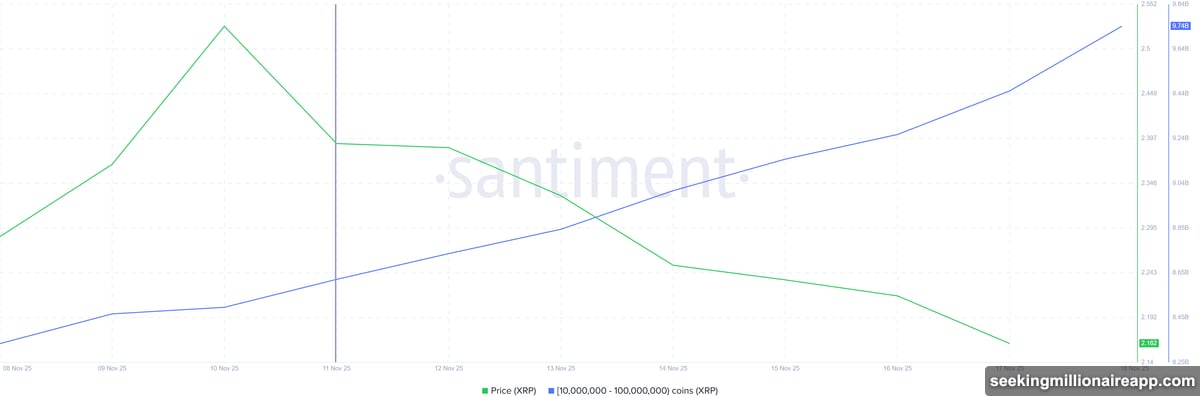

While retail sells, large holders are doing the opposite. Addresses holding between 10 million and 100 million XRP added 1.1 billion tokens in the past week alone.

That brings their total holdings to 9.74 billion XRP. At current prices, that represents $2.36 billion in fresh accumulation from this cohort. These aren’t small fish testing the waters. These are massive wallets making billion-dollar bets.

Whale behavior typically signals long-term confidence. Large holders have better market intelligence and longer time horizons than retail traders. So when they accumulate aggressively during price weakness, it suggests they expect recovery ahead.

Plus, whale buying often absorbs selling pressure from smaller holders. That creates a floor under the price even when broader sentiment turns bearish. The challenge is whether this whale demand can offset the rising retail selling.

The divergence between retail and whale behavior creates tension. One group is capitulating while the other doubles down. Which side proves right determines whether XRP holds two dollars or breaks lower.

ETF Approval Hopes Grow Stronger

XRP trades at $2.14 and sits directly on key support at the same level. The asset has been locked in a downtrend for nearly a month without breaking free.

But there’s a potential catalyst building. Bloomberg ETF analyst Eric Balchunas noted that the SEC released new guidance allowing issuers to accelerate filing effectiveness. That’s designed to clear the regulatory backlog faster.

Bitwise’s XRP ETF reportedly sits next in line for review. Any progress on approvals could instantly shift market sentiment from bearish to bullish. ETF approval would validate XRP as a legitimate investment vehicle and potentially trigger institutional inflows.

However, timing remains uncertain. If ETF decisions face delays or regulatory pushback, XRP risks resuming its slide. Without that external catalyst, the current selling pressure could overwhelm whale buying.

Two Paths Forward

If ETF anticipation continues building and whale accumulation persists, XRP could climb to $2.28 and then $2.36. That would break the month-long downtrend and confirm a trend reversal.

But if retail selling accelerates or ETF approvals stall, XRP might drop 6.8% to reach two dollars flat. Breaking that support level would invalidate the bullish case and potentially trigger another leg lower.

The whale accumulation provides a cushion, yet it might not be enough. Retail holders control significant supply, and their selling can overwhelm even aggressive whale buying in the short term. So XRP’s fate likely hinges on whether ETF news arrives before selling pressure peaks.

Watch the two-dollar level closely. That’s where this standoff between whales and retail gets resolved. One side will blink first.