Big crypto holders move opposite to small wallets. That creates the price swings nobody sees coming.

Santiment just dropped research that maps whale versus retail behavior for the first time. The pattern is clear. When large holders buy and small wallets sell, prices surge. When the opposite happens, markets tank.

This isn’t speculation. It’s visible in the data across Bitcoin, Ethereum, and XRP. Plus, understanding this dynamic gives traders actual alpha instead of just following the crowd.

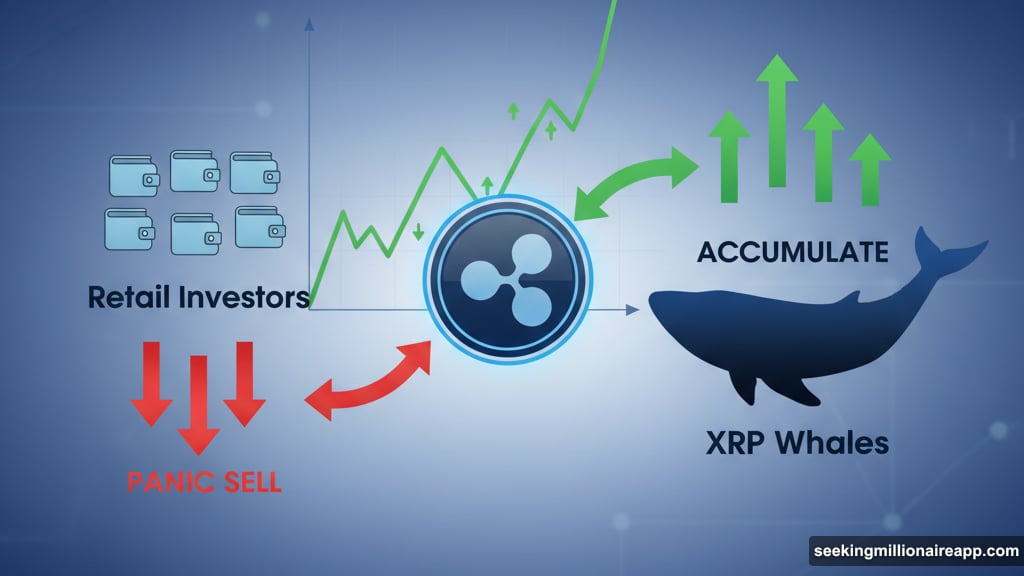

XRP Shows the Pattern Most Clearly

XRP struggled through late 2025. But retail wallets kept buying anyway. FOMO drove their decisions.

Meanwhile, whales accumulated selectively. They created short price spikes. However, the biggest gains came when whales bought while micro wallets were selling.

That divergence matters more than most indicators. Retail follows trends. Whales create them.

Since XRP hit its 7-year high above $3.62 in July, small holders kept buying even as prices cooled. But whale accumulation drove every temporary rally. Large holders set the tempo while retail just reacted.

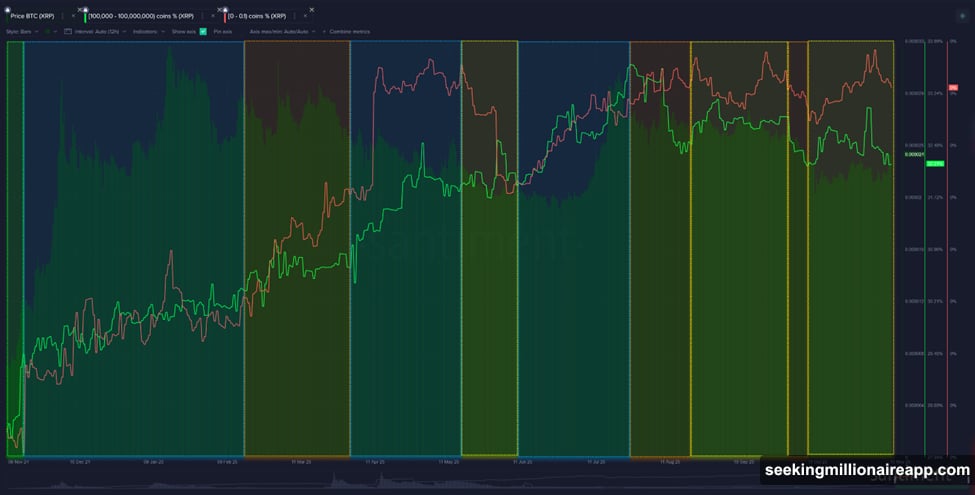

Bitcoin Whale Moves Preceded Every Major Rally

Bitcoin’s chart reveals the same dynamic. Major bull runs happened when whales added positions while retail sold.

Green bars on Santiment’s chart mark these accumulation periods. Each preceded significant upward momentum. Conversely, when whales offloaded and retail bought, prices declined.

The pattern repeats consistently. Retail chases pumps. Whales buy dips. That timing difference creates the volatility traders mistake for random market movements.

Ethereum Surged 87% During Whale Accumulation

Between June and August 2025, Ethereum jumped nearly 87%. Small wallets were selling the entire time.

Large holders accumulated strategically. Their buying pressure overwhelmed retail selling. So the price climbed despite negative sentiment among small investors.

This demonstrates how whale behavior can override retail trends completely. Market cap matters less than who’s buying and when they’re doing it.

Other Altcoins Follow the Same Script

Cardano whales accumulated during dips, stabilizing ADA prices. Meanwhile, micro wallets chased small rallies and missed the bigger moves.

Lido Staked ETH showed concentrated whale buying before price surges. Retail wallets stayed mostly inactive during these periods.

The consistency across multiple cryptocurrencies confirms this isn’t coincidence. It’s how crypto markets actually work. Large holders move first. Small holders react later. That time lag creates the opportunities.

Why Whales Win and Retail Loses

Retail investors follow crowd psychology. They buy when everyone’s excited and sell when panic hits. That guarantees buying high and selling low.

Whales operate differently. They accumulate when sentiment is negative and prices are depressed. Then they hold through volatility. Finally, they distribute when retail FOMO peaks.

This isn’t market manipulation. It’s just how large capital moves. Whales can afford to wait. Retail investors panic at every dip. So the patterns repeat endlessly.

Tracking Wallet Tiers Reveals Market Direction

Santiment’s research shows that monitoring wallet behavior provides more signal than traditional indicators. When whales and retail move opposite directions, major price swings follow.

Algorithmically identifying these windows could mark the next breakthrough in crypto trading. Such tools would show who’s driving prices and when.

Therefore, traders who incorporate whale versus micro wallet activity into their strategies gain a distinct edge. They see moves before they happen instead of reacting after the fact.

The Real Alpha Nobody Talks About

Most crypto analysis focuses on price action, trading volume, and technical patterns. But those metrics lag behind the actual driver of movements.

Wallet tier behavior leads the market. Large holders accumulate before pumps. They distribute before dumps. Everything else is just noise.

Here’s what matters. Stop watching price charts obsessively. Start tracking what different wallet sizes are doing. That reveals where the market is heading next.

The data is available. Santiment and similar platforms publish it. Yet most traders ignore it and stick with conventional indicators that everyone else watches.

Smart money doesn’t follow the crowd. It moves first while retail sleeps. Then it profits when retail finally notices and piles in. That cycle never stops.

Your edge comes from seeing what the crowd misses. Whale accumulation during retail selling is the clearest signal in crypto. Use it or keep losing to those who do.