Three altcoins are racing toward potential disaster. Traders betting big on XRP, Zcash, and Starknet could lose everything if prices reverse this week.

The problem isn’t just speculation. It’s overleveraged positions combined with warning signs most traders are ignoring. Let’s break down what’s actually happening and why $400 million in crypto could vanish fast.

XRP’s ETF Hype Masks Serious Weakness

Everyone’s talking about XRP exchange-traded funds. Canary Capital plans to launch its Spot XRP ETF on November 13. Plus, five more XRP ETFs from Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares just appeared on the DTCC list.

That sounds bullish. So traders piled into long positions expecting prices to surge.

But here’s the catch. New XRP addresses dropped sharply over the past week. That means fresh money isn’t flowing in despite the ETF excitement. Moreover, the MVRV Long/Short Difference declined, which historically signals price corrections ahead.

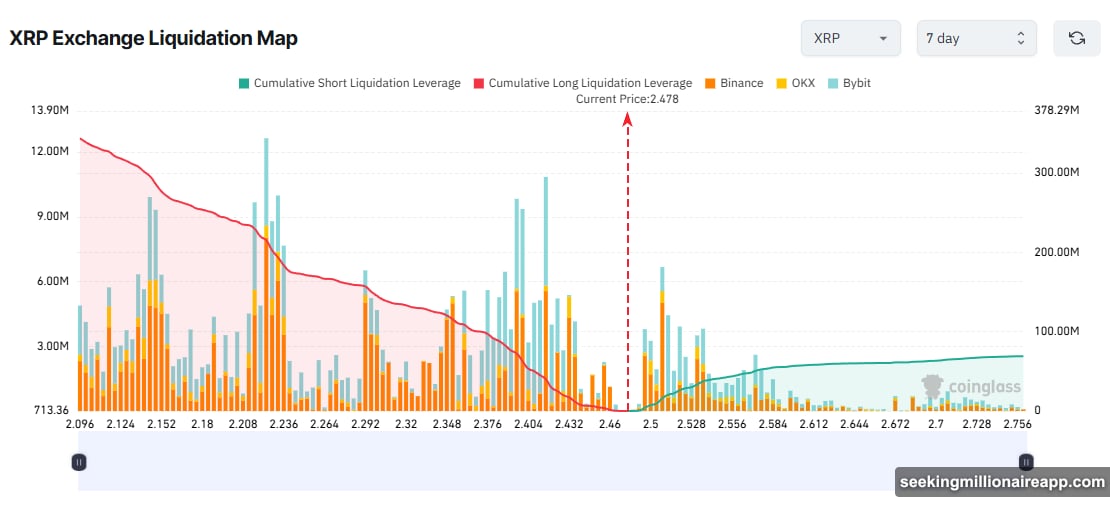

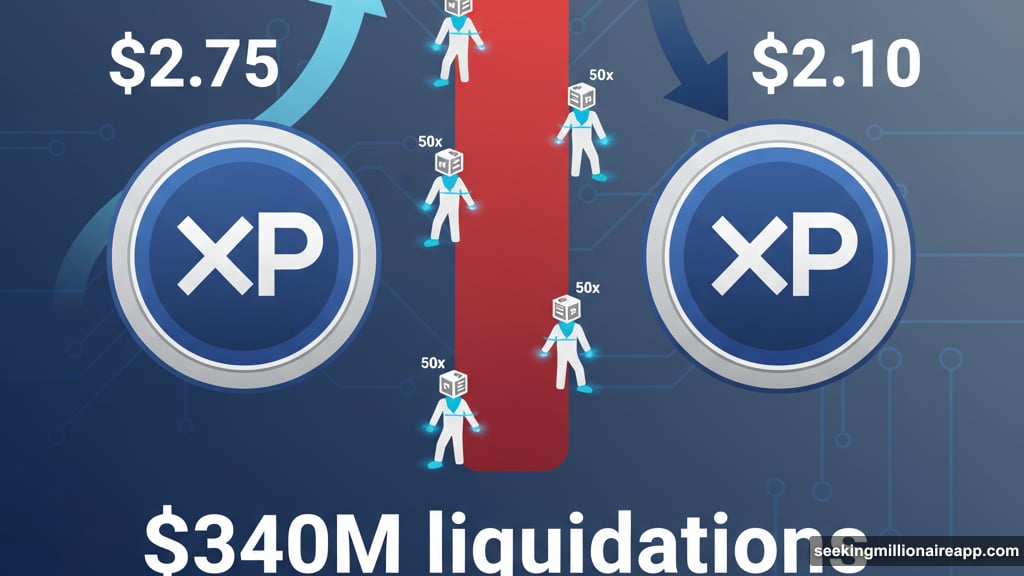

Liquidation maps reveal the danger. If XRP drops to $2.10, traders face more than $340 million in liquidations. That’s real money evaporating from overleveraged longs.

On the flip side, if XRP climbs to $2.75, shorts could lose around $69 million. But the data suggests longs face bigger risk right now. Too many traders bet the same direction without considering fundamental weakness.

Zcash’s 10x Rally Shows Classic Parabolic Warning

Zcash exploded recently. The privacy coin surged 10x, hitting $750 before pulling back to $658. Many traders still expect $1,000 next.

However, analysts see a different pattern forming. After a 10x rally, Zcash might be entering the final parabolic stage. These patterns rarely sustain without significant retracements.

Investor Gunn already took profits: “Just sold 90% of my ZEC. I’m bullish on the privacy thesis, but parabolic charts rarely sustain in the short run without a meaningful retrace. Too much short-term FOMO.”

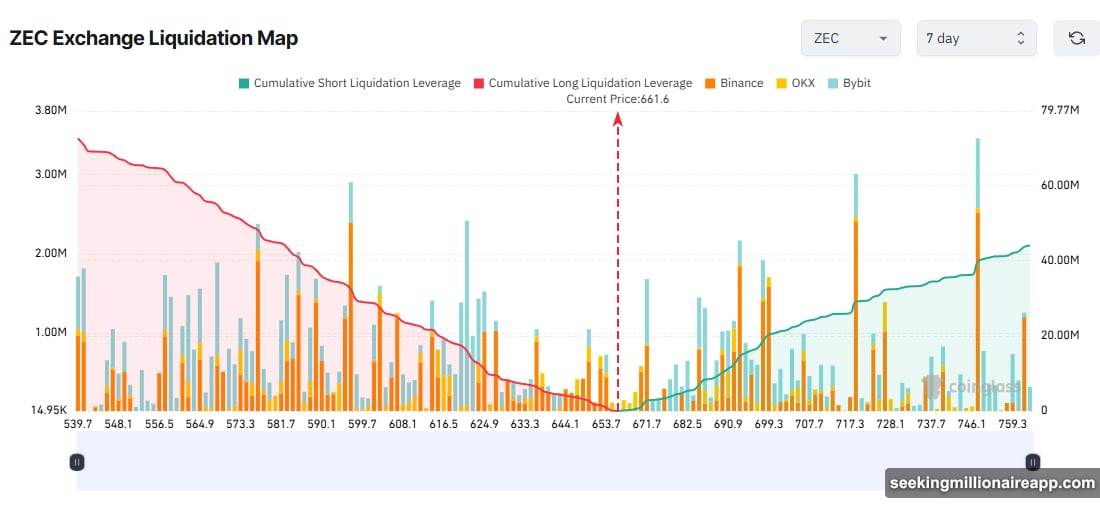

Liquidation data backs up the concern. If Zcash drops to $540, over $72 million in long positions get wiped out. Conversely, if it reaches $760, roughly $44 million in shorts disappear.

The problem? Traders loaded up on leveraged longs near the top. That’s exactly when parabolic patterns typically reverse. So the risk-reward ratio looks terrible for new long positions here.

Starknet’s Token Unlock Threatens Breakout Rally

Starknet surprised everyone with a 30% daily surge in early November. The rally recovered losses from October’s sharp decline. Plus, analysts spotted what looks like a breakout from long-term resistance.

That triggered optimism among derivatives traders. Liquidation maps show heavy concentration of long positions betting on continued upside.

But a major token unlock threatens the party. More than 127 million STRK tokens will hit the market this week. That’s massive selling pressure dropping right into a leveraged rally.

If Starknet falls to $0.128, approximately $14 million in long positions face liquidation. Meanwhile, if it breaks above $0.20, about $1.78 million in shorts get squeezed.

The math doesn’t favor longs here either. A scheduled supply increase often crushes price momentum, especially when traders are overleveraged expecting continuation.

The Real Risk Nobody’s Mentioning

These three altcoins share a dangerous pattern. Traders are stacking leveraged longs after strong rallies, ignoring fundamental weaknesses.

XRP faces declining new addresses despite ETF hype. Zcash shows classic parabolic exhaustion after a 10x move. Starknet confronts a massive token unlock mid-rally.

Yet liquidation maps reveal traders betting heavily on continued upside. That creates asymmetric risk. Small price drops trigger cascading liquidations, which can accelerate downward momentum.

Here’s what’s frustrating. The warning signs are obvious to anyone looking beyond price charts. But leverage amplifies both greed and fear. So traders chase momentum instead of managing risk.

What Happens Next

This week will test whether these altcoins can sustain their rallies. XRP needs to hold $2.10 to avoid triggering $340 million in liquidations. Zcash must stay above $540 or lose $72 million. Starknet has to absorb 127 million tokens without crashing below $0.128.

Those are narrow margins with massive consequences.

For traders holding leveraged positions, the smart move is reducing exposure. Take some profits. Cut leverage. Protect capital.

For everyone else, this is a reminder why overleveraging into momentum trades rarely ends well. The market rewards patience and punishes greed. Always.