Moving money across borders just got absurdly cheap. KPMG dropped a bombshell report showing stablecoins can slash international payment costs by 99%.

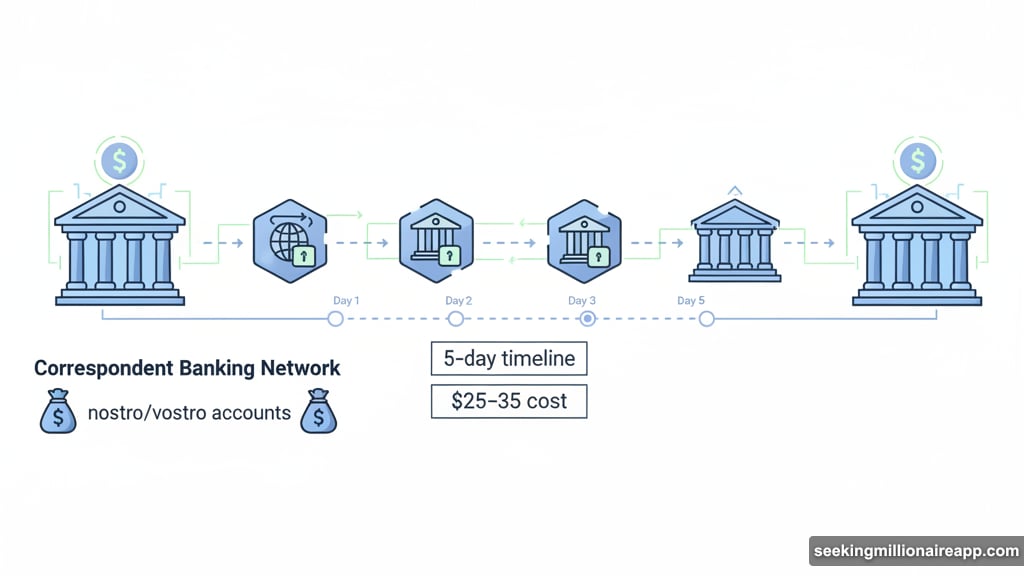

That’s not a typo. Banks currently charge $25 to $35 per wire transfer. Stablecoins handle the same transaction for pennies. Plus, settlement drops from five days to literal seconds.

No wonder major players like JPMorgan are already moving billions daily through blockchain rails.

The $150 Trillion Problem Nobody Fixed

Traditional cross-border payments are painfully broken. Banks shuffle roughly $150 trillion annually through correspondent banking networks that look ancient by modern standards.

Here’s how it works now. Your payment bounces through multiple intermediary banks. Each one takes a cut and adds delay. Meanwhile, the entire system takes two to five days just to confirm your money arrived.

But the real waste happens behind the scenes. Banks must park massive cash reserves in nostro and vostro accounts worldwide just to ensure liquidity. That’s capital sitting idle instead of generating returns.

KPMG’s report exposes what financial institutions have known for years. This infrastructure bleeds money and ties up resources that could work harder elsewhere.

Blockchain Rails Cut Through the Noise

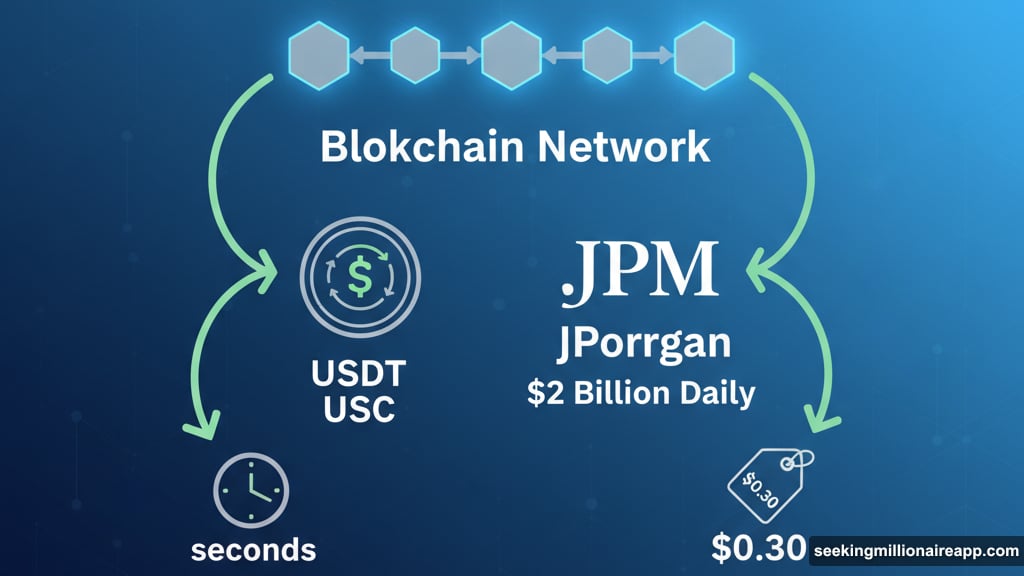

Stablecoins flip the entire model on its head. These dollar-pegged cryptocurrencies run on blockchain networks that settle transactions in minutes or seconds depending on the protocol.

Transaction costs plummet because you’re cutting out layers of intermediaries. Instead of $25 to $35 per transfer, you’re looking at costs that can drop below 30 cents. That’s a 99% reduction that makes small international payments suddenly viable.

Plus, the transparency improves dramatically. Traditional wire transfers operate in a black box. You send money and hope it arrives. Blockchain-based systems let you track every step in real time with full auditability.

Lower prefunding requirements also free up capital that banks currently trap in dormant accounts around the world. That liquidity can flow into more productive uses instead of just sitting as collateral.

JPMorgan Already Moves $2 Billion Daily

Early adoption signals this isn’t just theory anymore. JPMorgan processes about $2 billion in daily transactions through its blockchain platform right now.

That’s real money moving through real business operations. Not pilot programs or experiments. Actual revenue-generating payment rails that prove the technology works at scale.

PayPal launched its own stablecoin back in 2023. The PYPL stablecoin has grown to a $1.17 billion market cap in less than two years. That growth demonstrates clear market appetite for blockchain-based payment solutions.

Meanwhile, Tether’s USDT remains the largest stablecoin overall, followed by Circle’s USDC. Both play major roles in cryptocurrency markets but increasingly serve cross-border payment needs too.

These platforms offer something traditional banking can’t match. Speed, cost efficiency, and transparency all packaged into infrastructure that’s available 24/7 without banking hours restrictions.

Three Reasons Banks Fear This Shift

First, revenue gets obliterated. If transaction fees drop 99%, banks lose a massive profit center. Cross-border payments generate billions annually in fee income that stablecoins threaten to evaporate.

Second, control slips away. Banks currently act as gatekeepers who decide what money moves where and when. Blockchain rails reduce that power by creating alternatives that bypass traditional banking infrastructure entirely.

Third, the technology requires new expertise. Legacy banking systems run on decades-old protocols that staff understand well. Blockchain-based payments demand different skills and knowledge that many institutions lack right now.

So banks face a choice. Adapt by building or partnering with stablecoin platforms, or watch payment volume migrate to competitors who embrace the technology faster.

Tether and Circle Dominate, But Competition Heats Up

Tether’s USDT holds the top spot among stablecoins with massive market dominance. Circle’s USDC ranks second and appeals to institutions seeking regulatory compliance and transparency.

But the landscape is evolving quickly. PayPal’s entry signals that major fintech players see opportunity worth chasing. Plus, emerging platforms like Digitap are pressuring established blockchain payment networks such as Stellar and Ripple.

WisdomTree just launched Europe’s first physically backed Stellar Lumens exchange-traded product too. That development broadens regulated investor access and shows how traditional finance is building bridges into crypto infrastructure.

Competition drives innovation. More players entering the stablecoin space should push costs even lower while improving user experience and regulatory compliance.

Regulatory Clarity Still Lags Behind

Here’s the catch. Stablecoins operate in murky regulatory territory that varies wildly by jurisdiction.

Some countries embrace them as legitimate payment tools. Others remain skeptical or actively hostile. That uncertainty creates friction for banks considering blockchain-based payment rails.

Plus, regulators worry about financial stability risks if stablecoins scale too quickly without proper oversight. Questions about reserve backing, redemption mechanisms, and consumer protection still need better answers.

Yet KPMG’s report suggests regulatory frameworks are evolving toward greater clarity. The transparency and auditability that blockchain offers actually align well with regulatory expectations around tracking and compliance.

So expect more guidelines and rules as stablecoin adoption accelerates. Banks that engage constructively with regulators now may gain advantages over those who wait.

Small Payments Finally Make Economic Sense

Traditional wire transfer costs make small international payments impractical. Why pay $25 to send $50 to someone overseas?

Stablecoins flip that math completely. When transaction costs drop to 30 cents, suddenly you can send $10 internationally without losing half to fees.

That opens massive markets. Remittances, freelance payments, microtransactions for digital goods – all become viable when friction disappears. Plus, emerging markets benefit enormously from cheaper access to global payment networks.

KPMG’s report focuses on institutional adoption, but retail use cases matter just as much for long-term growth. The $150 trillion banks move annually represents only part of total demand for better cross-border payment solutions.

The Migration Has Already Started

JPMorgan’s $2 billion daily volume proves institutions are moving beyond pilots into production. PayPal’s stablecoin growth shows fintech companies see real opportunity.

Meanwhile, smaller banks and payment providers are partnering with stablecoin platforms to avoid building infrastructure from scratch. That strategy lets them offer competitive international payment services without massive technology investments.

Traditional correspondent banking networks won’t disappear overnight. But they’re facing competition that offers better speed, cost, and transparency. That pressure will only intensify as more institutions adopt blockchain rails.

So the question isn’t whether stablecoins will disrupt cross-border payments. KPMG’s data makes clear that’s already happening. The real question is which banks adapt fast enough to thrive in this new landscape.

Your international wire transfers are about to get dramatically cheaper and faster. Banks that embrace stablecoin technology win. Those that resist face shrinking relevance in a $150 trillion market that’s tired of waiting five days and paying $35 for something blockchain handles in seconds for pennies.