The U.S. government shut down Wednesday. Markets shrugged. But scratch beneath the surface and things look messier than Wall Street admits.

Gold hit its 39th record high this year. The dollar weakened. Treasury yields dropped after private payrolls disappointed. Plus, nobody knows when federal offices reopen or what data we’ll actually see before the Fed’s next meeting.

Most analysts say shutdowns barely matter for markets. They point to history showing minimal impact. But this shutdown arrives at a uniquely awkward moment for the economy.

Jobs Data Goes Dark Right Before Fed Decision

The shutdown blocks Friday’s employment report. That’s a problem. The Federal Reserve meets October 29 to decide interest rates. Without fresh jobs data, they’re flying partially blind.

Markets already priced in a quarter-point rate cut. In fact, trading data shows overwhelming consensus on 25 basis points. But what if the Fed needs more information before cutting?

Joe Brusuelas, chief economist at RSM U.S., highlighted the timing issue. The Fed relies heavily on employment data for policy decisions. So missing September’s numbers creates uncertainty.

Moreover, recent labor market data needed revisions. The shutdown stops those revisions too. That means the Fed works with potentially outdated numbers when they vote on rates.

Here’s the catch. If the shutdown extends for weeks, it could actually influence the Fed’s October decision. A prolonged shutdown might signal enough economic disruption to justify more aggressive cuts. Or it might create so much data fog that the Fed pauses entirely.

Dollar Takes Another Hit

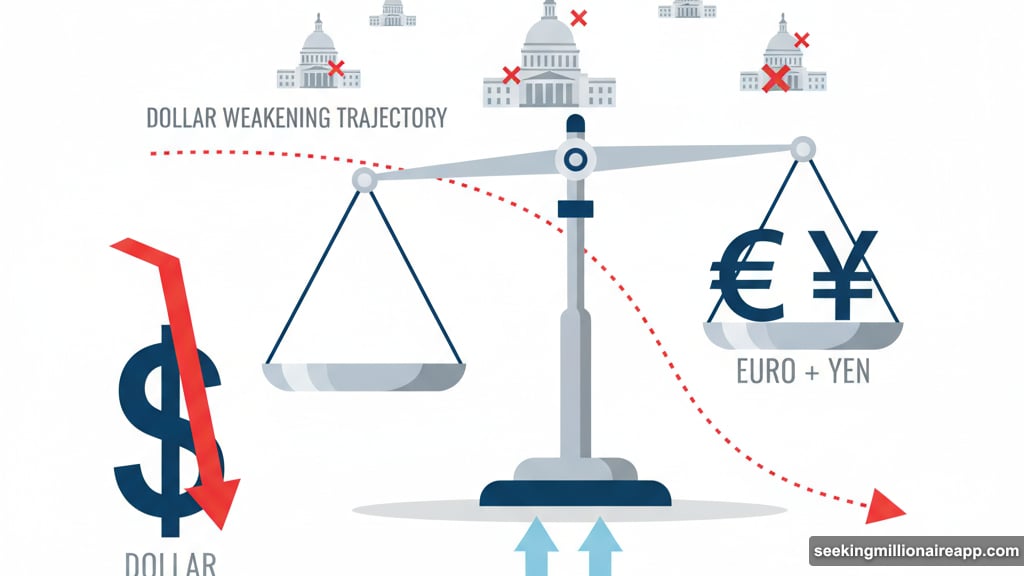

The greenback slipped further Wednesday. Brusuelas noted this could be the shutdown’s biggest market impact. Currency traders hate uncertainty. Plus, America’s fiscal dysfunction makes other central banks look stable by comparison.

Think about it. European bonds rallied Wednesday morning. Asian markets stayed calm. Meanwhile, U.S. assets showed more volatility. Investors are quietly asking whether American exceptionalism still holds.

Luke Bartholomew, deputy chief economist at Aberdeen, pointed to deeper credibility concerns. The shutdown adds to existing worries about U.S. fiscal policy and institutional stability. That’s not great when you’re trying to maintain the dollar’s reserve currency status.

Trump also threatened “a lot” of job cuts during the shutdown. If he follows through, that weakens consumer spending. Less spending means less demand for imports. So the dollar faces downward pressure from both political chaos and economic fundamentals.

Bartholomew expects capital to flow toward euros and yen if mass layoffs materialize. That shift could hurt American exporters who suddenly face stronger foreign competition.

Europe Watches Nervously

German automakers should pay attention. Brusuelas warned that widespread federal layoffs would slam demand for European exports. Specifically, he mentioned cars.

Federal workers buy vehicles. They also buy electronics, furniture, and everything else. So firing thousands of them creates a demand shock. That shock ripples across the Atlantic within weeks.

German industry already struggles with weak domestic demand and Chinese competition. Losing American customers makes things worse. Plus, currency shifts could price European goods out of U.S. markets entirely if the dollar falls too far.

Neil Birrell, chief investment officer at Premier Miton, sees broader diversification happening. Investors are moving into silver, crypto, and commodities. They’re reducing exposure to U.S. risk assets.

That makes sense. Bond markets already reacted to extreme government borrowing. Credit spreads sit tight. Equity valuations look stretched. So why stick around when Washington can’t keep the lights on?

Gold Shines While Stocks Stumble

Gold’s 39th record this year tells you everything. Investors flee to safety when institutions fail. The metal jumped Wednesday while U.S. risk assets wobbled.

European stocks gained momentum after a slow open. Asian markets mixed. American futures traded lower. That pattern suggests global investors see the shutdown as primarily a U.S. problem rather than a systemic crisis.

Treasury yields dropped 4 basis points on the 10-year note. Private payrolls came in weaker than expected. So bond traders bet on economic weakness even before the shutdown’s full effects materialize.

However, UBS analysts downplayed shutdown concerns in a Tuesday note. They argued past shutdowns caused only modest, short-lived market volatility. Economic impacts tend to be small because shutdowns eventually end.

But they’re missing the bigger picture. This shutdown arrives when markets already sit near all-time highs with demanding valuations. Any negative surprise gets magnified when prices reflect perfection.

The Dysfunction Premium Grows

Bartholomew made a crucial point about Federal Reserve independence. The Trump administration spent significant political capital trying to influence Fed policy. That erodes the institution’s credibility.

The Fed anchors global capital markets. When that anchor looks shaky, investors demand higher returns to compensate for added risk. That shows up as higher long-term bond yields and wider credit spreads.

American political chaos has costs. Real, measurable costs in basis points and currency values. The shutdown puts those costs on full display.

Plus, this marks at least the fifth major government funding fight in two years. Investors notice patterns. Each shutdown reinforces the narrative that American institutions struggle with basic governance.

That narrative matters for capital flows. If you’re managing a sovereign wealth fund, do you really want maximum exposure to a country that routinely threatens to stop paying its bills?

Markets Might Shrug. Or Might Not

UBS expects markets to look past shutdown fears. They point to continued Fed rate cuts, strong corporate earnings, and AI investment as more important drivers.

That view might prove correct. Past shutdowns typically resolved within days or weeks. Markets recovered quickly. Life went on.

But what if this time differs? Trump’s first-term shutdown lasted 35 days. It caused real economic pain. Federal workers missed paychecks. Contracts got delayed. Services stopped.

Extend this shutdown for weeks and it becomes impossible to ignore. Consumer confidence drops. Business investment pauses. Economic data gaps grow wider. The Fed faces genuine uncertainty about rate decisions.

Brusuelas suggested the shutdown would need to approach 2018-2019 length before seriously impacting Fed policy. That’s a high bar. Yet it’s not impossible given current political dynamics.

The Real Cost Nobody Calculates

Here’s what frustrates me. Shutdowns waste everyone’s time and money. They accomplish nothing productive. Yet they’ve become routine tools of political brinkmanship.

Markets eventually shrug off most political noise. But each shutdown chips away at American credibility. Foreign investors notice. Domestic investors adjust allocations. The dysfunction premium grows.

Companies delay hiring and investment decisions. Why commit capital when you can’t predict whether the government will function next quarter? That hesitation shows up in economic data months later.

So while Wall Street says “don’t worry, shutdowns don’t matter,” the cumulative effect absolutely matters. Each shutdown makes the next one more likely. Each funding crisis reinforces investor concerns about American governance.

Your portfolio might not crash this week. But you’re probably paying higher long-term costs than you realize. That shows up as permanently higher risk premiums on U.S. assets.

Watch the dollar. Watch gold. And watch whether investors keep trusting American institutions as dysfunction becomes the baseline expectation.