The crypto market collapsed overnight. Total market cap dropped $176 billion in hours, falling 5.7% before stabilizing near $2.9 trillion.

Even after the bounce, the damage remains. The market sits 4% lower than yesterday. Plus, Bitcoin led the selloff, dragging everything else down with it.

But here’s the thing. This wasn’t about bad news or regulatory panic. It was about leverage unwinding fast.

Half a Billion in Forced Liquidations

Over $576 million in long positions got liquidated across major exchanges in 24 hours. That’s real money vanishing as traders got margin called.

Bitcoin and Ethereum took the biggest hits. Leveraged traders betting on price increases got wiped out as stop losses cascaded. So when prices dipped below key levels, forced selling accelerated automatically.

This explains why losses came so fast and hit so broadly. No major crypto-specific news drove the drop. Instead, crowded long positions unraveled in a feedback loop that crushed prices.

The mechanics were brutal but predictable. Traders borrowed too much. Prices fell slightly. Exchanges forced liquidations. Those sales pushed prices lower. More liquidations triggered. Repeat until leverage cleared out.

Macro Fears Made Everything Worse

Global markets spooked crypto traders too. Speculation around tighter Bank of Japan policy weighed on risk assets worldwide.

Crypto still trades like a high-beta asset. When macro conditions get uncertain, crypto amplifies the moves. Meanwhile, the combination of macro jitters and excessive leverage left the market defenseless.

Gold climbed to $2,605, just $80 below its all-time high. Bitcoin fell under $101,000. That divergence tells you everything about risk appetite right now.

Some analysts point out that BTC/Gold RSI below 30 has historically marked long-term Bitcoin bottoms. Maybe. But that’s cold comfort when your portfolio is bleeding today.

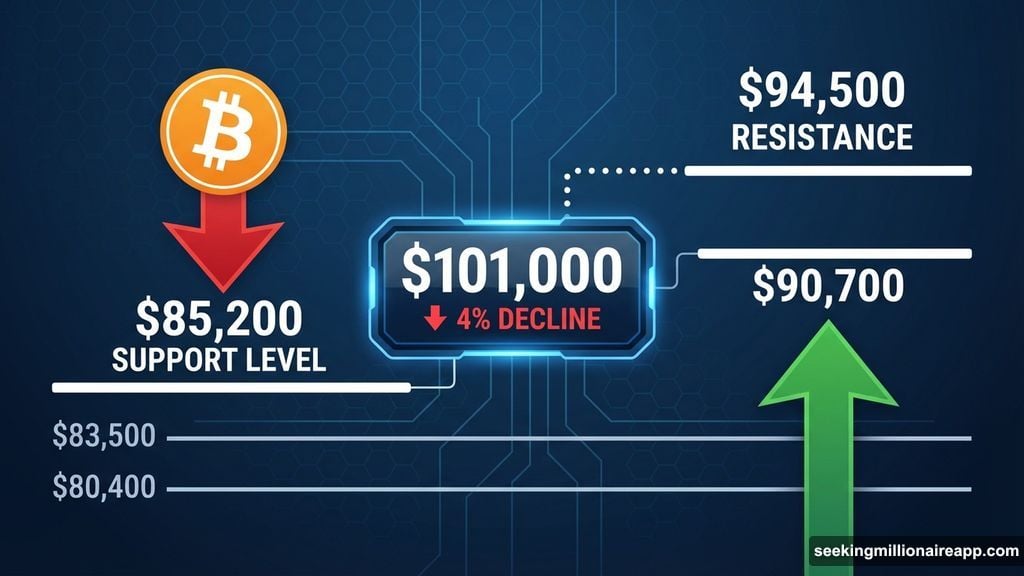

Bitcoin Must Hold $85,200

Bitcoin dropped just over 4% but defended an important support level at $85,200. That line separates controlled pullback from deeper correction.

If support fails, downside opens toward $83,500. Below that, $80,400 comes into play if liquidations accelerate again. Yet one positive sign emerged: long-side leverage is thinning as price falls, reducing forced selling risk.

For Bitcoin to regain momentum, it must reclaim $90,700. That represents a 5.5% recovery from current levels and would signal buyers stepping back in. A move toward $94,500 could follow, though that remains a major resistance zone rather than a confirmed target.

Right now, Bitcoin’s ability to hold $85,200 will dictate broader market direction. Break below and panic could spread. Hold and the market might stabilize.

Total Crypto Market Cap Turns Critical

Market capitalization now sits 32% below its October peak. The $3 trillion level turned into a psychological battleground.

Reclaiming $3.00 trillion would stabilize sentiment. Breaking above $3.25 trillion would reopen upside toward $3.59 trillion and $3.94 trillion. But that requires sustained buying pressure and reduced leverage risk.

On the downside, support at $2.81 trillion to $2.73 trillion is holding for now. A sustained break below this zone would signal deleveraging isn’t finished. More pain would follow.

The market structure remains fragile. Without fresh capital inflows or reduced macro uncertainty, bounces will likely face selling pressure.

HYPE Token Leads the Collapse

Hyperliquid got absolutely destroyed. The HYPE token dropped over 9% in 24 hours and nearly 12% from yesterday’s peak.

Price action continues trending lower, making it one of the biggest laggards among large-cap altcoins. However, the daily chart shows early exhaustion signs.

Between November 22 and December 16, HYPE printed a lower low while RSI formed a higher low. This bullish divergence suggests selling pressure may be fading. But confirmation is missing.

For any rebound to gain credibility, Hyperliquid must reclaim $29.68 on a daily close. A move above that level opens upside toward $36.78. Until then, rebounds risk being short-lived.

Critical support sits at $26.01. A daily close below exposes $20.39, keeping downside risks firmly in play.

XRP ETFs Show Inflows Despite Weakness

Spot XRP ETFs logged 20 straight days of inflows, nearing $1 billion total. Meanwhile, Bitcoin and Ethereum ETFs bled $4.6 billion combined.

Yet XRP price remains weak. This highlights a delayed price response that confuses traders. Inflows should support price, but selling pressure elsewhere in crypto overwhelmed the positive signal.

The disconnect suggests institutional money is positioning for longer-term XRP exposure while retail traders exit. Whether that bet pays off depends on broader market recovery.

Trump Teases Crypto Privacy Debate

President Trump said he would review clemency for Samourai Wallet’s founder. This reopens debate around crypto privacy and regulatory overreach.

The news could drive speculation around privacy-focused coins. But outcomes remain uncertain. Regulatory battles rarely resolve quickly, and traders should avoid overreacting to hints without concrete policy changes.

Still, any shift toward crypto-friendly policy would be welcome. The market desperately needs positive catalysts beyond technical bounces and leverage cleanouts.

What Happens Next

The market sits at a crossroads. Bitcoin must hold $85,200 or risk deeper drops. Ethereum faces similar pressure. Altcoins like HYPE need to reclaim key levels or face further losses.

Leverage has thinned considerably, reducing forced liquidation risk. That’s good. But macro uncertainty remains. Bank of Japan policy decisions could trigger fresh volatility. Plus, year-end positioning often brings unexpected moves.

For now, the best strategy is defensive. Avoid adding leverage. Wait for clear support confirmation before buying dips. Watch Bitcoin’s $85,200 level religiously.

This selloff cleared out weak hands and excessive leverage. That process was painful but necessary. Markets don’t go straight up forever. Corrections happen. The question is whether this correction is finished or just beginning.

My take? Bitcoin holds here or we see $80,000. Simple as that.