Zcash just proved markets don’t care about yesterday’s winners. While Bitcoin bounced 6% and most altcoins followed, ZEC crashed another 4% in 24 hours.

That brings the weekly damage to 40%. Plus, buying pressure collapsed 97% overnight. So what turned one of 2024’s best performers into December’s biggest loser?

The answer lies in the same factor that powered its 650% surge.

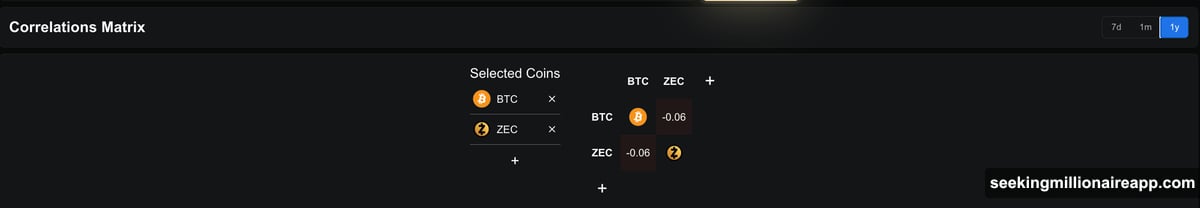

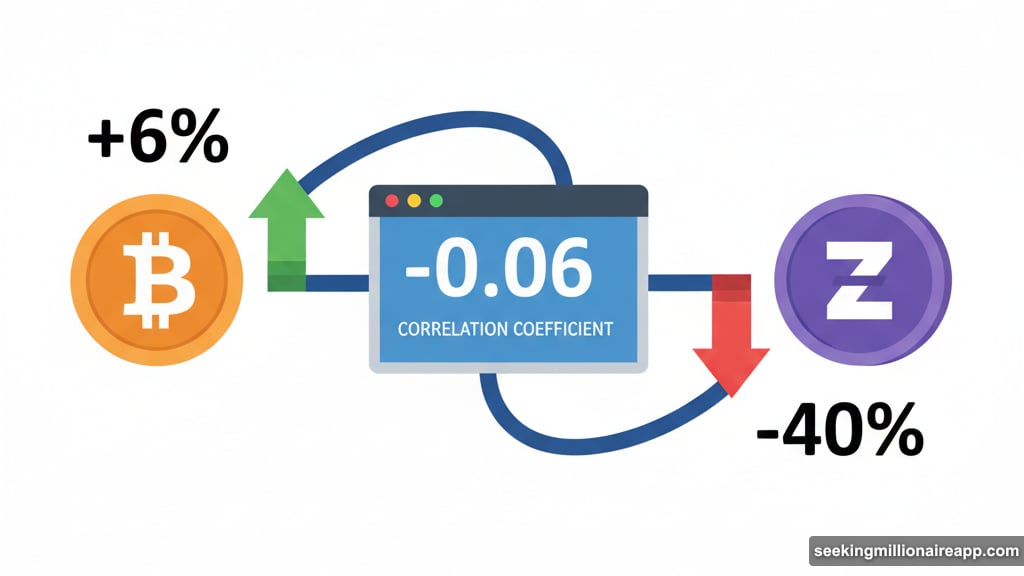

Negative Bitcoin Correlation Just Flipped Against ZEC

For most of 2024, Zcash moved opposite to Bitcoin. The one-year Pearson correlation coefficient sits at -0.06. That negative relationship became ZEC’s superpower during late October and November.

Bitcoin struggled while Zcash exploded higher. Traders who understood this inverse pattern rode massive gains. In fact, ZEC surged 650% in three months while BTC consolidated.

But now Bitcoin is rallying. And that same negative correlation is crushing Zcash. When BTC rises, ZEC falls. The relationship that protected ZEC during Bitcoin weakness now works as a structural headwind.

Moreover, technical indicators confirm the pressure. The 20-day exponential moving average is closing in on the 50-day EMA. A bearish cross would signal momentum loss and potentially extend the 40% weekly decline.

The trend that made Zcash resilient has become its biggest liability.

Buying Pressure Collapsed 97% in One Day

The most alarming signal appeared between December 1 and December 2. Exchange outflows, which track buying demand, crashed from $61.06 million to just $1.74 million.

That represents a 97% collapse in buying pressure within 24 hours. Traders who aggressively accumulated during the October-November rally suddenly vanished. Nobody’s stepping in to catch the falling knife.

However, one element prevents total capitulation. Wyckoff volume analysis shows selling pressure also weakening over the past two sessions. Yellow bars indicating seller dominance have gradually faded.

A similar pattern emerged between October 23 and 25. Soon after, buyers regained control with blue bars appearing. Then ZEC rallied 230%.

So while buying collapsed, selling is also reducing. This leaves Zcash at a conflicted turning point. Yet weakening activity on both sides could trap ZEC in range-bound consolidation rather than trigger recovery.

Critical Support Levels Now Define the Outcome

ZEC’s next move depends on holding key support zones. The first line sits at $299. Losing this level exposes the $210 region where previous reactions formed temporary bases.

Further breakdown would drag Zcash toward $124. That level marks early-cycle reset territory. Nobody wants to see that scenario play out.

For recovery to develop, ZEC must reclaim $426. That’s a 34% bounce from current prices. Breaking above $426 would mark the start of a reversal attempt and restore some technical confidence.

If buyers push through that ceiling, the next major resistance remains $736. ZEC failed to break this barrier since early November despite multiple attempts.

What Happens Next Depends on Two Factors

Zcash sits at a crossroads. Its historical strength—moving opposite to Bitcoin—now weighs down price action. Buying pressure collapsed 97% while bearish technical setup nears completion.

Only two factors keep breakdown from becoming inevitable. First, selling pressure must continue easing. If sellers regain control with volume, ZEC could test $299 and below.

Second, buyers need to reclaim $426 to stabilize the trend. Without that recovery move, the path of least resistance points lower.

Right now, ZEC trades caught between collapsing demand and weakening supply. That’s not a recipe for stability. It’s a setup for volatility that could break either direction with force.

Watch those levels. They’ll determine whether Zcash stabilizes or extends this brutal December decline.