Zcash just demolished most of the crypto market with gains that seem almost fictional. Up 230% in a month. Over 1,200% in three months. Yet every signal suggests this rally has more room to run.

Most altcoins pump and dump within weeks. Zcash keeps climbing without the typical exhaustion signs that kill rallies. So what’s different this time? The data tells a story about real buying power taking control.

Whales Are Still Accumulating

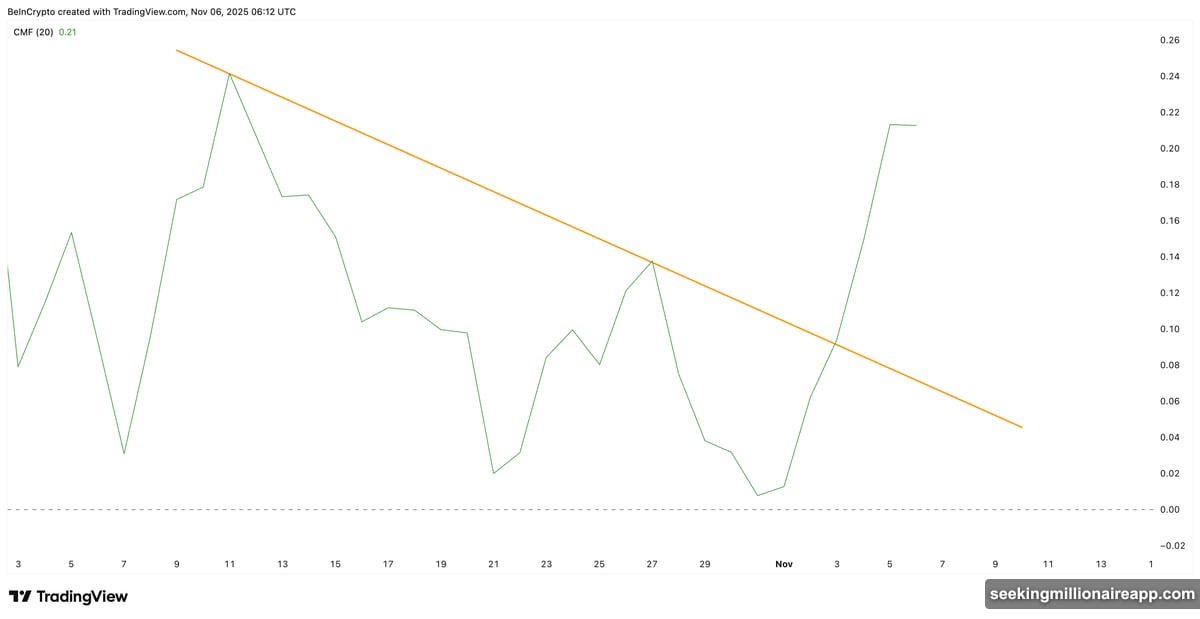

The Chaikin Money Flow indicator reveals who’s actually moving the market. Right now, it’s not retail traders chasing pumps.

CMF broke its downtrend on November 3. It currently sits at +0.21, well above the zero line that separates buying from selling pressure. That number confirms large wallets continue adding to positions rather than distributing to retail buyers.

This pattern typically appears during healthy continuation phases. Not at exhaustion tops. The difference matters because CMF above zero means institutional money keeps flowing in, providing fuel for further gains.

Exchange Selling Dried Up Fast

Here’s where things get interesting. Spot netflow data shows retail panic-selling has essentially stopped.

On November 4, nearly $42 million worth of ZEC hit exchanges for sale. Two days later? Just $3.66 million. That’s a 91% drop in selling pressure within 48 hours.

Why does this matter? When retail stops dumping coins on exchanges, whales can push prices higher without fighting constant sell walls. The path of least resistance turns upward.

Plus, this decline in exchange inflows suggests most weak hands already exited. The holders left behind likely have stronger conviction and higher price targets.

Volume Confirms This Isn’t Fake

The On-Balance Volume indicator separates real rallies from manipulation. It adds buying volume on up days and subtracts selling volume on down days.

OBV has maintained an upward trendline since early October. Even during brief price dips, volume support held firm. That means each pullback attracted more buyers rather than triggering cascading liquidations.

Rising prices with rising volume create the strongest technical setup. It proves genuine demand exists at higher prices, not just speculation or algorithmic trading creating artificial movement.

OBV never broke below its October 30 support level. That’s unusual stamina for an altcoin rally. Most tokens show volume divergence — price climbs while volume falls — before major corrections. Zcash shows the opposite pattern.

The Flag Breakout Changed Everything

October 24 marked a technical shift that few traders noticed at the time. Zcash broke out of a flag pattern that had constrained prices for weeks.

Since that breakout, the token extended gains without meaningful consolidation. It now trades near $518, up 18% in 24 hours alone. But the technical structure suggests room remains before hitting resistance.

The next key level sits at $594, aligned with the 1.618 Fibonacci extension. A break above that opens the path toward $847 — the 2.618 target representing a potential 60% gain from current prices.

That’s not random price prediction. Fibonacci extensions measure how far breakouts typically travel based on the previous consolidation range. They work because traders worldwide use them, creating self-fulfilling technical levels.

Support Looks Rock Solid

Every rally eventually pulls back. The question is where support catches prices.

For Zcash, that level appears to be $384. It has absorbed selling pressure consistently since November 1 without breaking. Multiple tests of support without breakdown typically strengthens that level rather than weakening it.

Only a sustained close below $384 would suggest this rally exhausted itself. Given current momentum and volume support, that scenario seems unlikely in the near term.

However, crypto moves fast. Support levels that held for weeks can break in hours if market conditions shift. Smart traders watch for volume spikes on support tests — low volume bounces are sustainable, high volume failures trigger deeper corrections.

Why This Rally Feels Different

Most altcoin pumps follow predictable patterns. Retail FOMO drives initial gains. Whales distribute to late buyers. Volume divergence appears. Then prices collapse.

Zcash is doing something else entirely. Whale accumulation is increasing, not decreasing. Retail selling dropped 91% in two days. Volume supports each new high rather than showing exhaustion.

These patterns rarely appear together. When they do, rallies tend to extend far beyond initial expectations because genuine demand exists at higher prices.

Plus, Zcash offers actual privacy features that differentiate it from most altcoins. As regulatory pressure increases on transparent blockchains, privacy coins might attract renewed attention from users seeking financial sovereignty.

That fundamental use case provides organic demand independent of market speculation. Combined with technical strength and strong hands accumulating, the setup looks unusual for 2025’s altcoin landscape.

What Could Stop This Move

No rally lasts forever. Several factors could interrupt Zcash’s climb.

Regulatory crackdowns on privacy coins remain a constant threat. Exchanges might delist ZEC if pressure increases, cutting off liquidity and access. That risk never fully disappears for privacy-focused cryptocurrencies.

Additionally, Bitcoin dominance shifts affect all altcoins. If BTC suddenly rallies hard, capital often flows out of alts regardless of individual coin strength. Zcash wouldn’t be immune to that rotation.

Finally, technical patterns work until they don’t. A surprise breakdown below $384 would invalidate the bullish structure and likely trigger algorithmic selling. Volume would spike as stop-losses hit, potentially creating a sharp correction.

The Big Picture

Zcash’s 1,200% three-month gain stands out even in a market full of explosive moves. But unlike most altcoin pumps, this one shows characteristics of sustainable strength rather than speculative mania.

CMF above zero confirms institutional inflows. The 91% drop in exchange selling shows retail exhaustion. Rising OBV proves volume backs each new high. The flag breakout on October 24 provided technical structure for the rally.

Together, these signals suggest more upside remains before exhaustion appears. The $594 resistance level represents the next major test. A break there opens the path toward $847.

However, crypto markets can shift overnight. Support at $384 must hold for this analysis to remain valid. A break below that level would change everything.

For now, though, Zcash looks like one of the few altcoins with room to run rather than distribute. The whales keep buying. Retail keeps holding. Volume keeps rising. That combination rarely leads to immediate tops.